Where the Candidates Stand on Taxing Matters

• 3 min read

- Brief: Taxes

Get the Latest Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

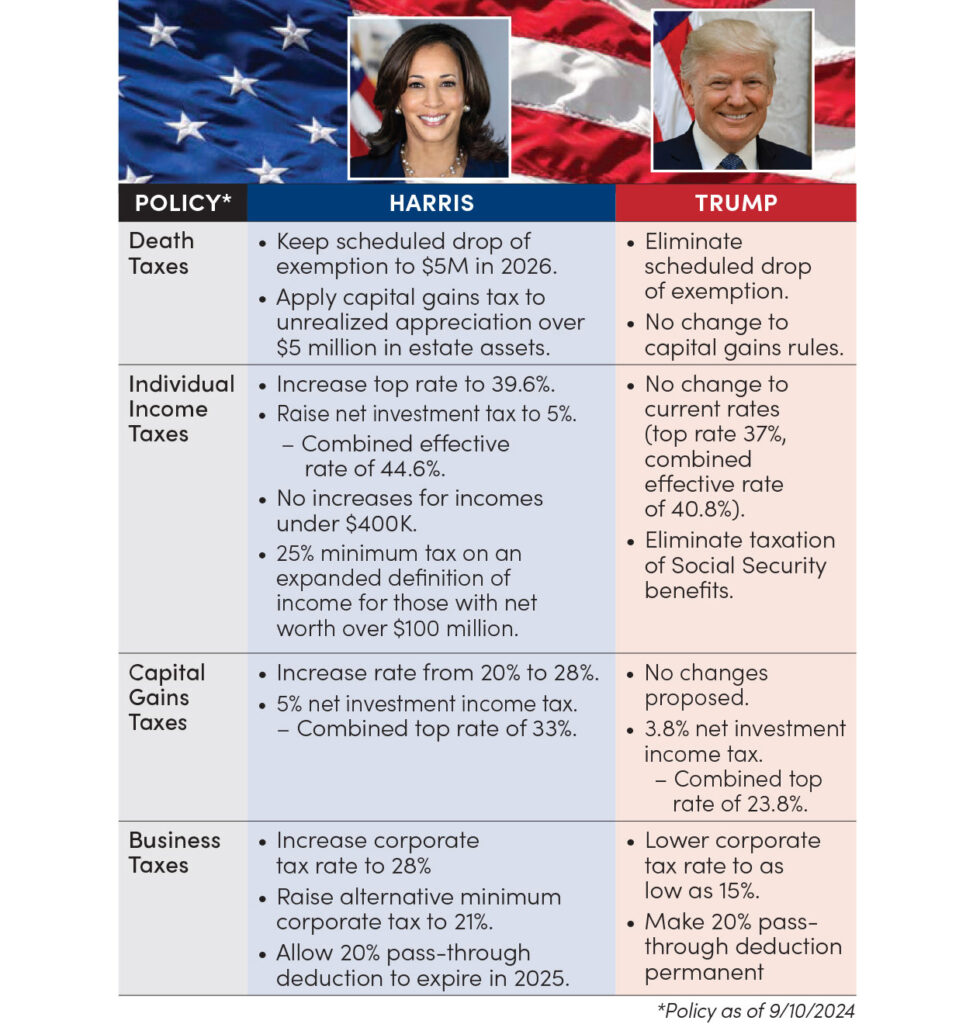

Both presidential candidates are making numerous proposals concerning taxes. Many are fuzzy on the details, but here is a look at key “official” proposals reported by the Kamala Harris and Donald Trump campaigns:

Death taxes – Currently, a federal estate tax with a top rate of 40% is levied on the market value of a decedent’s estate in excess of an effective lifetime exemption of $13.6 million. Unrealized appreciation in estate assets is subject to no further tax.

- The exemption is scheduled to drop to $5 million (inflation-adjusted from 2018) starting in 2026. Harris proposes no change to the drop. Trump wants to eliminate it.

- Harris proposes applying capital-gain taxation to unrealized appreciation over $5 million in estate assets. Trump proposes no change to capital-gain-related rules.

Individual income taxes – Wage and other ordinary income after allowed deductions is now subject to taxation at a sliding scale that maxes out at 37%. Also, a tax of 3.8% is applied against net investment income above a threshold amount (e.g., $250,000 for married filing jointly), bringing the combined top marginal rate to 40.8%. The deduction allowed for state and local taxes paid is limited to $10,000.

- Harris proposes lifting the top ordinary tax rate to 39.6% and the net investment tax rate to 5% for a combined rate of 44.6%. There would be no tax increases for taxpayers with incomes under $400,000. In addition, a minimum tax of 25% would be levied on an expanded definition of income, which includes unrealized gains, for taxpayers with net worth more than $100 million.

- Trump has not proposed any change to current rates but has proposed the exclusion of all Social Security benefits from taxable income.

Capital gains taxes – Qualified dividends (ordinary dividends of domestic corporations) and capital gains (appreciation in value) are taxed when realized, usually when dividends are received, or an asset is sold. The current top rate applied is 20%. However, both dividends and gains are included in net investment income and taxed up to an additional 3.8%, as indicated above.

- Harris proposes moving the current capital-gains rate to 28%. Together with a 5% net investment income tax, that would put the combined top rate of tax at 33%.

- Trump proposes no changes.

Business taxes – Corporate taxable income is subject to tax at a flat federal rate of 21%, but large corporations are subject to an alternative minimum tax of 15% of adjusted financial statement income. Certain business organizations (e.g., proprietorships, partnerships, and subchapter S corporations) pass through all or part of their income to the business owners, who are obliged to report such income on their individual income tax returns. However, subject to certain income-related limitations, they are effectively allowed to deduct 20% of the pass-through deduction on their individual returns.

- Harris’s proposals would increase the regular corporate tax rate from 21% to 28% and the alternative minimum corporate tax rate to 21%. They would also allow the 20% pass-through deduction to expire in 2025.

- Trump’s proposals include lowering the regular corporate tax rate to as low as 15% and making the 20% pass-through deduction permanent.

HOW AMG CAN HELP

Not a client? Find out more about AMG’s Personal Financial Management (PFM) or to book a free consultation call 303-486-1475 or email us the best day and time to reach you.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.