Tariffs and the Turbulence Ahead

• 8 min read

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.

The aggressive level of tariffs announced recently by President Trump on virtually every other country has elevated uncertainty and volatility, but it is not the time to panic.

To explain the economic implications and dispel misconceptions, AMG presented a webinar discussion on April 15 titled “U.S. Tariffs: Despite the Chaos, Don’t Panic.” The discussion was moderated by AMG Chairman Earl Wright and featured AMG Chief Investment Officer Dr. Michael Bergmann; Dr. Jarek Strzalkowski, Global Macro Economist; and Josh Stevens, Senior Vice President, AMG Capital Management.

In AMG’s view, the impact of the tariffs will almost certainly lower economic growth and raise domestic prices. However, a recessionary bear market appears unlikely.

Diversified portfolios are important in moments like these. History shows that recoveries can be just as sharp as the drops—and missing the recovery can be far more damaging than riding out the drops.

Where We Stood on 4/15/2025 …

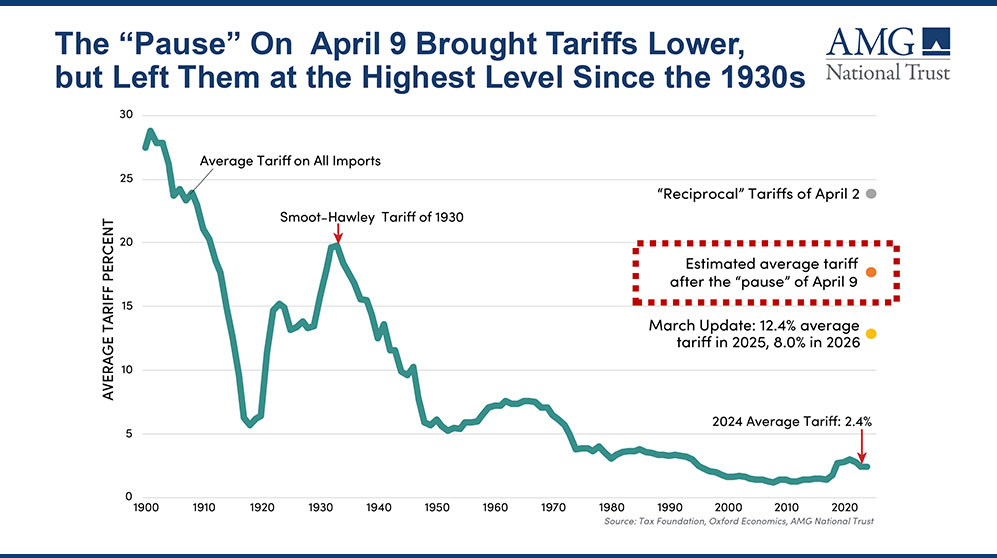

The current level of tariffs is something not seen in the post-World War II era, Dr. Strzalkowski said, and even the tariffs implemented in the first Trump administration “only registered as a blip.”

The tariffs established by President Trump consist primarily of an across-the-board minimum base levy of 10%, with a higher “reciprocal” tariff in some cases, and are more aggressive than many anticipated. The outcome remains in flux amid a 90-day pause, with the door open for negotiations or further retaliation.

… And The Reaction from Trading Partners

Smaller economies, such as those in Southeast Asia, appear likely to cut some kind of deal.

Larger, wealthier economies, such as in Europe, may be a different story. They don’t want to antagonize the United States, but this is a storm that they can potentially weather, Dr. Strzalkowski said.

“After all, when you think about Europe’s reaction, Europe only has a trade dispute with the United States. The United States has now a trade dispute with most of the world, right?”

China is a far more complicated story because there also are political issues involved. In addition, the 145% tariff imposed by Washington on imports effectively amounts to an embargo. However, Americans rely on a great many products made in China, including smartphones and consumer electronics, and both sides will be affected if that relationship becomes strained.

Expectations on Economic Growth & Inflation

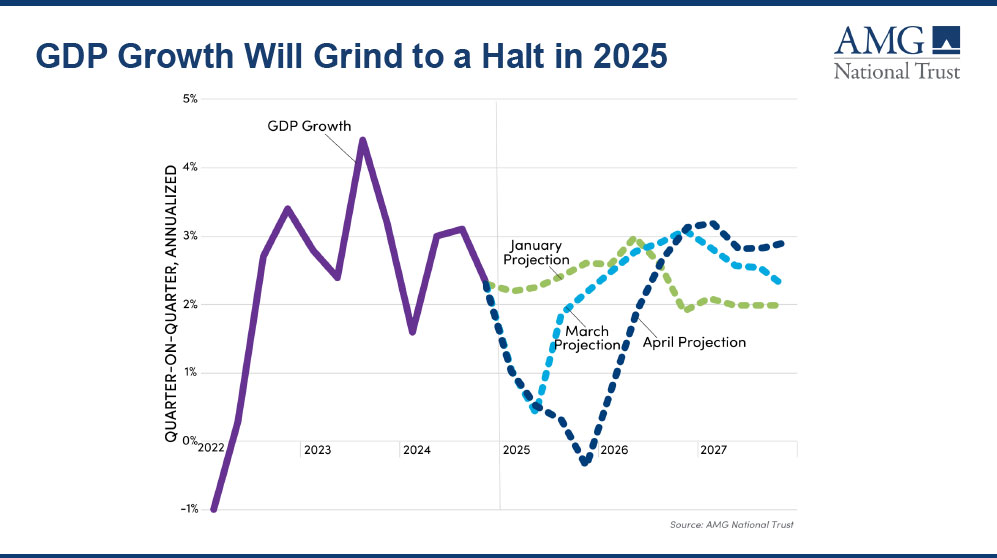

AMG’s three-year economic outlook, released in January, anticipated a soft landing in 2025 that factored in tax cuts and limited tariffs. However, Dr. Strzalkowski said that in the confusion around policy announcements and reversals and the higher costs for imported goods, that scenario has since been revised downward with the expectation of GDP growth slowing to below 1% this year and potentially recovering somewhat in 2026.

“We might see one or two quarters where the GDP growth is negative, but even if we see that, we probably shouldn’t panic too much,” he added.

He pointed out that the United States remains a very large and relatively closed economy, with international trade making up only about 11% of GDP and that we should be “able to weather the whole storm.”

The Federal Reserve (Fed), though, is in the “uncomfortable position” of being confronted with a slowing economy and, because tariffs would be likely to push inflation higher, the Consumer Price Index (CPI) inflation could potentially touch 4% later in 2025.

“I don’t think this is going to result in a long, sustained inflation, and probably later this year, the Fed will be in a position to start cutting rates a little bit. … Perhaps three or four cuts by early next year.”

Tariff Turbulence vs. Previous Crises

The tariff turbulence is certainly real, Dr. Bergmann said, but of a lesser order of magnitude than previous events, such as the COVID-19 pandemic or the 2008 financial crisis. It’s probably not permanent either, given the talk about being open to negotiating.

Placing tariffs on exports related to, for example, national security and defense seem to make sense. “But then there are those that sell us bananas and coffee. Why would we have a tariff on that? Are we going to increase domestic production? Probably not,” he said.

While these events could just be a matter of adjusting to a new global environment, there are a number of danger signs ahead.

“It is going to increase inflation temporarily, which creates real potential for danger,” Dr. Bergmann said.

Disruptions in supply chains and a drop in growth can be expected, he added. Liquidity issues in some market segments could also become a concern.

“(But) it’s not the end of the world, and it’s not like what we’ve seen” in these other periods.

“Toxic Mix” Roils Market

The back and forth so far in April around tariffs has roiled markets and elevated uncertainty for investors and for companies trying to make decisions around allocating capital.

Mr. Stevens summarized the situation as a “toxic mix that was a combination of yes, falling stocks, but also rising Treasury bond yields and a weakening U.S. dollar.”

Of the three, he said, it was the rising U.S. Treasury bond yields that likely attracted policymakers’ attention and led to the 90-day pause for negotiation and evaluation.

The pause is a positive step, he added, but what the markets are really looking for is greater clarity on the long-term tariff policy.

“We’re not going to get that tomorrow. … markets will continue to be focused on the path of trade negotiations and tariff negotiations. And to the extent that we see those that occur, leading to that greater clarity on what the long run steady state is [for global trade policy], we’ll see markets begin to heal.”

Surprises Ahead for Investors?

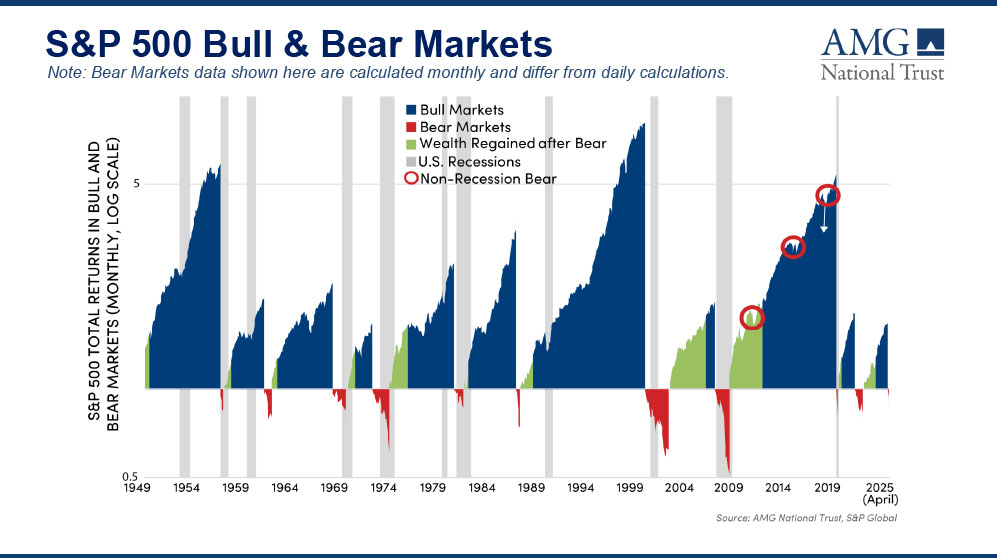

The turmoil has left some investors fearing the prospect of an extended bear market.

Bear markets fall into three levels of severity—each reflecting a different policy response to an economic challenge.

- Non-recession bear markets – The least severe bear market is one in which stocks fall roughly 20% and the economy endures a growth scare but avoids recession. The stock market drawdown is often sharp and short-lived, about three months on average, before returning to its prior peak in the same three-month average timeframe. Often these bear markets can be caused by events that shock the economy and elicit a rapid policy response that reverses the market’s downward trajectory. Like market corrections, these are barely visible looking backward.

- Recession bear markets – A “garden variety” recession often involves a rise in the unemployment rate of two percentage points or more, as well as the standard two consecutive quarters of contracting GDP. Bear markets with recessions often last 12 months, give or take, and require both the right size and mix of policy to reverse the economy’s direction of travel. Market declines in recession bear markets average about 28%.

- Recession bear markets with deleveraging – These are particularly rare, with only three instances in the post-WWII era. Two conditions generally need to be met for a deleveraging bear. First, economic excesses need to have permeated the economy for some years prior to a catalyst event. Second, an initially inadequate policy response allows the bear market to continue. These rare animals can lead to 40%-50% declines lasting 12-24 months.

Importantly, AMG does not expect a recession bear market with deleveraging to occur!

In the years since the financial crisis of 2008, there have been three non-recession bear markets. In each instance, the market turned around and rallied relatively quickly.

Mr. Stevens’ general suggestions for investors: Diversify, avoid panic, and do not jump out of the market and risk missing upward movements in the market.

Investor Guideposts

Below is a summary of AMG’s views on navigating the current wave of uncertainty around tariffs:

- The impact of the tariffs will almost certainly lower economic growth and raise domestic prices but should not be catastrophic.

- Markets are reacting to the economic implications of tariffs and to the high level of uncertainty surrounding policy right now. Market sell-offs like this are common, but we don’t expect a recessionary bear market with deleveraging currently.

- History shows that recoveries can be just as sharp as the drops—and missing the recovery can be far more damaging than riding out the drops.

- Diversified portfolios are important in moments like this—when staying invested can be hardest to do but matters most.

HOW AMG CAN HELP

In a quickly changing, uncertain environment, AMG helps clients manage the short term and achieve goals in the long term around each client’s unique circumstances. Find out more about AMG’s Personal Financial Management (PFM) or to book a free consultation call 303-486-1475 or email us the best day and time to reach you.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.