Stock Options Can Greatly Magnify Your Earning Potential—If You Manage Them Properly

• 11 min read

Get the Latest Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

KEY TAKEAWAYS

- Understanding the Basics of Employee Stock Options. Employee stock options are often given as part of a compensation package to attract and retain talented employees as well as incentivize them to help the company succeed.

- Using Stock Options To Achieve Financial Goals. Stock options are an opportunity to share in a company’s success but can also pose unique investment challenges, such as concentration risk or lack of diversification.

- Tax Consequences. The type of stock options you hold and the timing of when you exercise the options can have varied tax implications.

Employee stock options are a common component of executive compensation packages as an incentive for attracting and retaining key employees. They can also help magnify your earning potential.

However, understanding the intricacies of stock options—from knowing what type of options you have been granted and when they vest, to managing when to exercise them and the tax implications—is crucial for maximizing wealth building opportunities.

WHAT ARE STOCK OPTIONS

Contrary to their name, stock options are not actual shares of stock, but rather a contract that gives employees the ability to buy shares of a company’s stock at a predetermined price, known as the exercise or strike price, during a specified timeframe. In general, you must work for the company for a specific length of time, known as the vesting period, before you can exercise any options.

Benefit to Employer. The granting of stock options (such as 80% salary and 20% options instead of 100% salary) allows a company to delay some upfront expenditures, which can be particularly beneficial to startups with limited capital. Stock options are also a form of employee equity compensation that serve to attract prospective employees and retain current talent.

Risk to Employee. If the company were to seek bankruptcy protection or go out of business, common shareholders, such as employees, could risk losing their investment entirely or receive a fraction if forced to line up behind preferred shareholders.

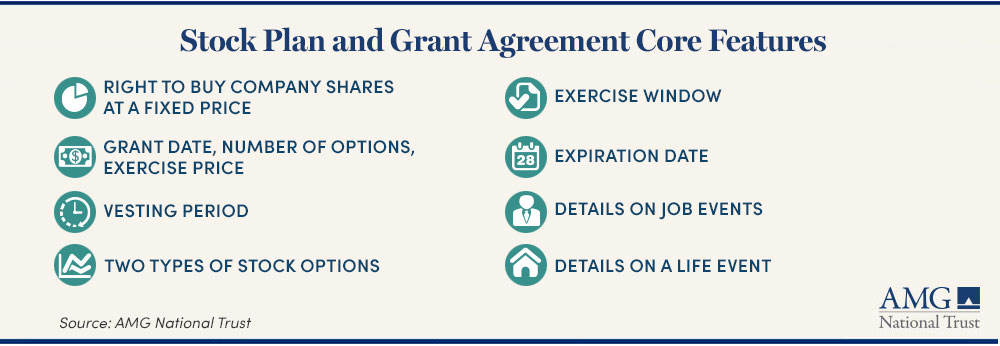

There are also tax and securities laws around stock options, but many of the variables are left to the company’s discretion. Guidelines are generally provided within the stock plan and grant agreement, both of which will be important for you to review to take full advantage of your company’s offer. The grant agreement typically will provide key details such as:

- The grant date (the specific date your options are given to you).

- The number of options you will receive.

- Type of options: Incentive stock options or nonqualified stock options.

- The strike/exercise price: The price you pay to buy the shares.

- Vesting schedule: The length of time before you gain the right to exercise any of the options.

- Exercise window: Fixed period of time in which you can exercise your options.

- Expiration date: The date an option contract expires and can no longer be exercised.

- Details on job and life events (e.g., leaving the company, death)

TWO COMMON TYPES OF STOCK OPTIONS

Non-qualified stock options and incentive stock options are the two most common types of stock options issued. The biggest difference between the two is who is eligible to receive the options and how they are taxed.

Non-qualified stock options (NQSOs)

These are the most common stock options and can be issued to employees at any level or to consultants and board members. Generally, there is no limit on the dollar amount of options that can be exercised by an individual per year. NQSOs are taxed both at exercise and when shares are sold.

When exercised, the difference between the exercise price and the stock’s market value is considered compensation and thus taxable as ordinary income. For example, if you were granted 15,000 stock options at $10/share (exercise price), and the stock is valued at $20/share (market value) at time of exercise, the $10 difference per share is taxed as ordinary income.

Generally, your employer will withhold the appropriate taxes—income tax, Social Security, and Medicare. When you sell the shares, any stock appreciation that occurred from the exercise date is taxed according to capital gains (or loss) rules.

Incentive stock options (ISOs)

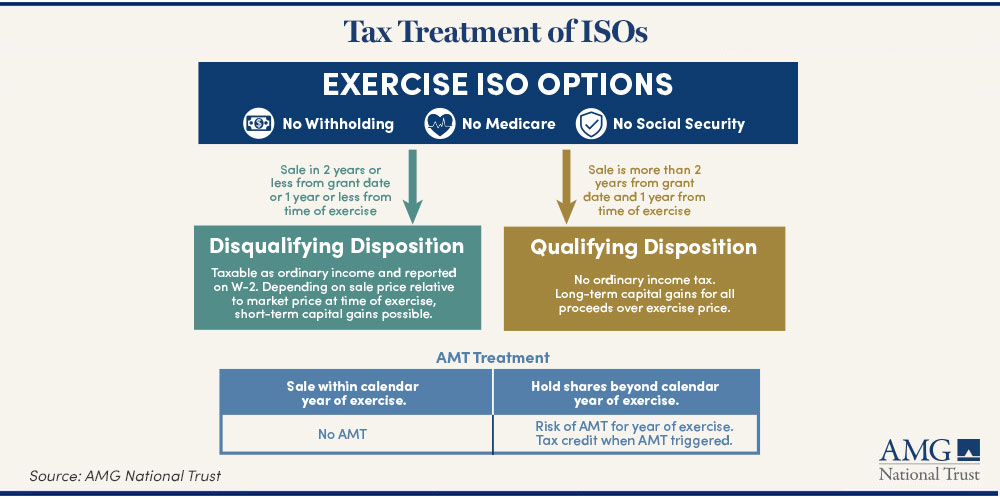

These are typically reserved for employees and have complex taxation rules depending on when you sell the shares. Key things to know about ISOs are:

- Unlike NQSOs, ISOs do not trigger income withholding taxes (Social Security, Medicare, etc.) upon exercise.

- It is not until the shares are sold that a taxable event occurs. There are two types of dispositions that you need know:

- Qualifying disposition — a sale after the required holding periods of two years from the grant date and one year from the exercise date.

Any gain (or loss) over the exercise price falls under capital gain/loss tax rules. This makes ISOs more favorable because capital gains results in more favorable tax rates (0%-20%) compared to ordinary income tax, which for high-income earners can be up to 37%. - Disqualifying disposition — a sale before the required holding periods have been met. If holding periods have not been met, then the sale is treated like a NQSO.

- Qualifying disposition — a sale after the required holding periods of two years from the grant date and one year from the exercise date.

- While ISOs have tax advantages over NQSOs, they can also trigger alternative minimum tax (AMT) events, which can be hefty. It’s important to work with a financial advisor to understand your risks.

- The $100,000 rule applies: The maximum amount of ISOs that may become exercisable in one calendar year is limited to $100,000. Options with a value exceeding $100,000 will be treated as an NQSO.

How Do Stock Options Work?

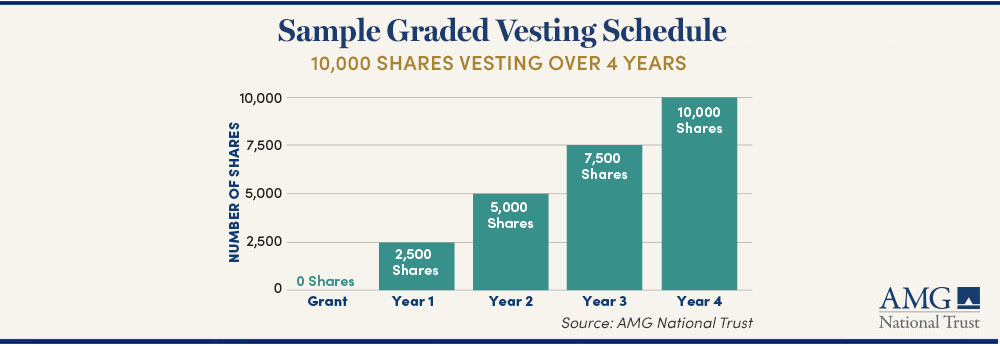

Vesting: When you are granted options, you must follow the vesting schedule, which dictates when you can begin to exercise your options: either all at once (cliff vesting) or in a series over time (graded vesting). The requirements generally will be outlined in the stock plan and grant agreement.

Exercising: Exercising stock options means you are purchasing the company’s stock at the predetermined exercise price to receive actual shares of your company’s stock, which you can then hold or sell depending on your financial strategy and any compliance or regulatory restrictions.

As an example, you start a new job and as part of your compensation package you are granted 10,000 stock options that have a four-year vesting schedule. Your exercise price is $10/share, and under the graded-vesting schedule, 25% of your options will vest over each of the next four years (2,500 options/year). After four years of employment, all your options will become exercisable. Now, let’s say that after those four years the stock price has risen to $20. The options give you the right to buy 10,000 shares of the company’s stock at your exercise price of $10/share versus the current market price of $20/share.

USE STOCK OPTIONS TO ACHIEVE FINANCIAL GOALS

The benefit of being granted stock as part of a compensation plan is that the shares can be a pivotal part of your broader financial strategy. Stock options can significantly accelerate progress toward financial goals such as paying off your home, purchasing a second home, funding children’s education, or planning for an early retirement, but they require thoughtful planning to maximize their benefits.

Creating a comprehensive financial plan that incorporates stock options involves several critical components.

- Have a plan: To get the most out of your stock options, understand your entire financial picture and identify your financial goals. Without a comprehensive strategy, you may risk losing out on opportunities, not getting the maximum value out of your options, or inadvertently triggering a taxable event that is not tax efficient.

- Optimal timing for exercising options: Deciding when to exercise stock options is another critical element in leveraging them effectively. This decision should be based on several factors such as:

— Their value and time to expiration: How high is the bargain element and how much time do you have prior to expiration?

— Personal income needs: You will want to determine if exercising your options fits within your financial plan and goals.

— Tax consequences: Have you optimized the income tax owed and are you aware of the income tax withheld at the time of exercise? - Concentration risk: A critical risk for executives is having too much wealth tied up in company stock, potentially exposing you to excessive company-specific risk. If your company is doing well, you can benefit from a concentrated position. If that changes, there could be a meaningful loss of wealth. It is important to have a financial plan to account for things like your financial security, liquidity needs, and life stage.

TAX CONSEQUENCES

Exercising stock options can have a potentially large tax impact, and involving a financial planner early on may result in more favorable financial outcomes.

To better understand the tax implications, let’s look at two examples.

Scenario 1: Senior engineer exercising and selling NQSOs

Elizabeth is a senior engineer at a tech company. She was granted 10,000 NQSOs when she joined the company, with a strike price of $15 per share. When Elizabeth is able, she exercises her options at a market price of $40/share and holds the resulting shares.

The difference between the market price at exercise and the exercise price is $25 per share ($40 minus $15) and is taxed at her ordinary income tax rate.

One year after exercising, Elizabeth decides to sell her shares when the market price rises to $50 per share. The capital gain is $10 per share ($50 minus $40).

Since Elizabeth held the shares for more than a year after exercise, the $100,000 gain ($10 multiplied by 10,000 shares) is considered a long-term capital gain, which is taxed at a lower rate than ordinary income.

Financial implications:

- Plan for immediate tax impact: Because exercising NQSOs triggers a taxable event, you should prepare for the immediate tax implications this will have on your income.

- Tax diversification: Consider diversifying the timing of exercising options to manage tax brackets more effectively across multiple years.

Scenario 2: CEO exercising ISOs with alternative minimum tax (AMT) implications

Tom is the CEO of a Fortune 1000 biotech firm. Upon assuming the role, he was granted 10,000 ISOs at an exercise price of $10 per share.

The company has shown significant growth under Tom’s leadership. The current market price is $50 per share, and Tom decides to exercise his options, one year after the grant date.

The market value is $40 per share ($50 minus $10), for a value of $400,000. While an ISO will not be subject to income tax or payroll taxes, the $400,000 is considered taxable income for AMT purposes. The AMT liability will be compared to his regular tax liability, potentially triggering a significant AMT liability.

Selling ISO shares

Tom exercised 10,000 ISOs when the stock price was $50. He now holds shares worth a market value of $500,000 at the time of exercise. One year after exercising, the company’s stock price is up to $70 per share. After a discussion with his financial advisor, Tom decides to sell the 10,000 to pay for a second home. Proceeds of the sale are $700,000.

The capital gain is $60 per share ($70 minus $10).

Since Tom held the shares for the required holding periods, the $600,000 profit qualifies as a long-term capital gain.

Financial implications:

- Long-term capital gains tax: Depending on his overall income, the federal long-term capital gains tax rate could range from 15% to 20%. Assuming the lower rate, Tom’s federal income tax on the capital gains would be $600,000 x 20% = $120,000

- Net proceeds: After taxes, Tom would net $700,000 minus $120,000 = $580,000

In addition to the tax consequences, because Tom is CEO of a large company, he must also adhere to SEC regulations for insider trading. Tom set up a trading plan for selling his stocks as part of the 10b5-1 rule, which permits him to sell a predetermined number of shares at a predetermined time.

Would You Benefit From a Free Consultation?

Stock options not only represent a portion of your potential earnings but can also play a crucial role in your broader financial strategy. However, maximizing the value and benefit of your stock options hinges significantly on proper management, a deep understanding of their complexities, and knowing how they fit into your entire financial picture and your long-term financial goals.

Additionally, AMG works with executives at companies who offer an employer-sponsored financial planning benefit. If your company is interested in offering such a valued program to key senior executives, explore Executive Financial Counseling.

Through our comprehensive, integrated approach to wealth management, AMG can help those with stock options evaluate their choices, avoid potential tax consequences, and put together integrated strategies for reaching financial goals.

Call 303-486-1475 or email the best day and time to reach you.

DOWNLOAD REPORT

This free, 4-page report will help you understand stock options and strategies for exercising them.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.