Sustainable Investing at AMG

• 9 min read

Get the Latest Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

EXECUTIVE SUMMARY

How do you employ your capital? Do you invest in equities and bonds, or donate to charities and philanthropic endeavors? Many investors do both to achieve two different goals: financial returns and giving back to their communities. For those investors, these two goals represent mutually exclusive uses of their capital. Sustainable investing is a growing type of investing that may offer certain investors the ability to invest with both goals in mind. Similar investing is sometimes called Socially Responsible Investing or ESG (Environmental, Social and Governance) Investing.

Sustainable investing is a way for investors to merge traditional financial investment goals with their personal values.

Sustainable investing is an umbrella term that covers a variety of ESG-focused uses such as:

- A way to screen out businesses that don’t align with an investor’s beliefs

- Finding companies that better align with an investor’s goals

- Actively engaging with a company’s owners to change business practices

- Honing into an area of ESG, such as clean water

- Directly investing in companies that attempt to make a positive impact

Investors interested in this approach have several questions to answer before choosing companies to invest in or choosing an investment strategy that takes ESG criteria into consideration.

- How do I want to generate financial returns and/or invest with my values in mind?

- What is the relative importance of these two goals in my portfolio and how do I balance them?

- What investments broadly fit my goals? Do they align with my values?

- How do I measure whether the investment is successfully meeting my expectations?

The right approach depends on the investor and his or her specific goals. This paper reviews different ways to sustainably invest, how investors may assess sustainable investing strategies, and some trends in the sustainable investing space.

WHAT IS SUSTAINABLE INVESTING?

Sustainable investing allows investors to generate financial returns, while considering their views on environmental impacts, positive social outcomes and responsible governance structures. Historically, sustainable investments focused on avoiding investing in companies that produce or sell “sin products” such as tobacco and liquor. More recently, some sustainable investment managers have started to seek out companies that positively align with the manager’s investors’ values. Sustainable investing has also tended to mirror the political and social climate of the time. For example, in the 1960s investors wanted to contribute to causes such as women’s and civil rights as well as the anti-war movement. Today, there has been a growing trend toward investing in businesses that are environmentally responsible.

Assessing ESG criteria is subjective, so it is important that investors find investments that match their personal goals and values. Some investors’ sustainably-oriented strategies may consider criteria that are not related to the financial performance of the investment, but rather allow for active engagement with ownership. For example, in 2007 shareholders submitted a proposal for the large financial services institution Wells Fargo to set greenhouse gas emission reduction goals. This would have a positive environmental impact, but the impact on Wells Fargo’s financial success is less clear.

Yet, some ESG criteria have a measurable impact on the financial success of the company. For example, in 2010 British oil and gas company BP’s oil spill in the Gulf Coast resulted in significant fines for the company. This had a strong impact on the company’s environmental standing as well as their financial results. An investor with a sustainable focus could approach BP in several ways. If you are already an investor, you may choose to divest. Others may choose to invest at a reduced price and actively engage with ownership to try and change business practices. Still others may look to invest in other oil companies that have good track records on environmental safety.

These examples are not intended to dictate how an investor should behave in various situations, but rather to highlight the inherent subjectivity when assessing ESG-related criteria. Consideration of these types of factors in investing may or may not have a material impact on the financial results of the portfolio, but investors can still consider whether such factors align with their unique value sets.

THERE ARE MANY TYPES OF SUSTAINABLE INVESTING

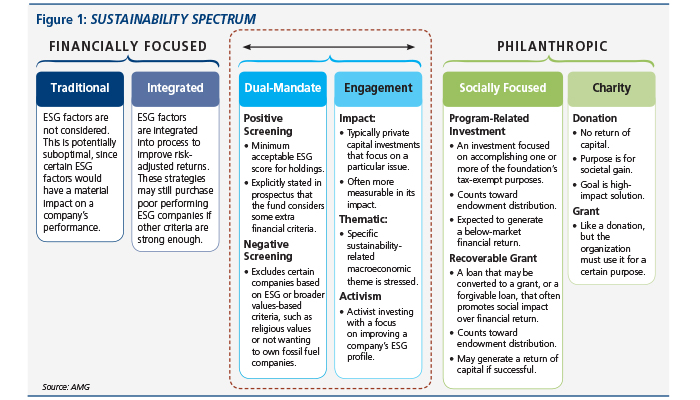

Investors can think of using their capital along a spectrum, which is stylized as the Sustainability Spectrum in Figure 1. On one side of the Sustainability Spectrum are financially focused investments. On the other, are societally focused philanthropic endeavors, like donating to charity or issuing grants.

Sustainable investing introduces a few additional options outside of traditional investing and charitable donations. For example, many active managers today take an integrated approach to ESG factors, but only to improve risk-adjusted returns. These investment managers focus on ESG criteria that are material to risk, return or both.

One step closer to a societally focused strategy are dual-mandate approaches. These investment strategies take ESG criteria and traditional investing criteria and build both into their processes. However, these strategies often have minimum ESG criteria for a stock to enter their portfolio and occasionally use ESG criteria to help weight positions. They often consider ESG criteria that may be immaterial to financial risk or reward.

Farther to the right on this spectrum are engagement-focused investments, which are often found in private capital vehicles. These are often investments made in a specific theme or industry that the investor has a passion for, like solar power.

Rounding out the spectrum are traditional philanthropic endeavors, like donations to a dearly held charity or providing various forms of grant funds.

There are no one-size-fits-all solutions along this spectrum. It is purposely expansive given the wide range of investor preferences. This serves as a useful tool for categorizing investment strategies and helping to identify which approach makes the most sense in an investor’s portfolio.

A FRAMEWORK FOR ASSESSING SUSTAINABLE INVESTMENTS

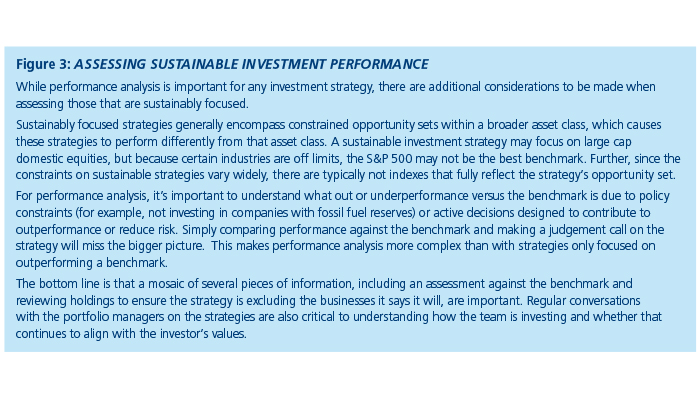

Assessing sustainable investments goes beyond the criteria used for traditional investments. (For a snapshot of some important areas to research with traditional investments, see Figure 2 “Assessing Traditional Investments”). AMG expects its active managers to integrate any ESG criteria that may be material to financial returns into their investment processes, and generally consider the active managers as falling under the “Traditional” or “Integrated” areas of the Sustainability Spectrum.

For Dual-mandate or Engagement strategies, investors may add a four-step process on top of traditional investment research criteria:

- Sustainability Categorization: At this stage, where the strategy fits along the Sustainability Spectrum is defined. Many strategies have components from several categories. For example, an investment strategy may only invest in companies with strong ESG ratings based on proprietary research, while screening out any company that derives more than 10% of its revenue from fossil-fuel related activities. This would be a combination of positive and negative screening types of dual-mandate investing defined in the Sustainability Spectrum graphic. This may also include categorizing the strategy’s approach to engagement with management and any thematic tilt the strategy might have. An example of a thematic tilt might be focusing on companies encouraging gender diversity, or companies focused on improving access to water.

- Sustainability Research: For an investment strategy to deliver on the sustainability research mandate, a well-disciplined research process must be defined. Some key criteria to look for are experienced and well-tenured ESG analysts who look at both ESG and financial criteria, a long-standing commitment to incorporating ESG factors into the strategy and an ability to talk about the companies within the portfolio from an ESG perspective.

- Historical Sustainability Assessment: Critically assessing how well the investment strategy has achieved its sustainability mandate is important. There is no straightforward answer to this assessment. While there are ESG ratings agencies that provide the average ESG score of companies within a portfolio (like credit ratings for bonds), these scores vary significantly from issuer to issuer. A holistic use of these ratings, discussions with the investment manager and reviews of the investment manager’s reporting are all tools that can be used to get a comprehensive view of historic sustainability.

- Communication Framework: Given the inherent subjectivity in sustainable investing and the lack of common metrics, frequent dialogue and reports from the investment manager are important tools in understanding how well the strategy is executing on its sustainability mandate. Transparency from the investment manager is needed to ensure that they are delivering on the dual-mandate consistently through time.

SUSTAINABLE INVESTING GOING FORWARD

Changing demographics and growing demand have fueled a rise in ESG investment opportunities. These developments in turn afford AMG a wider opportunity to identify compelling ESG-related strategies.

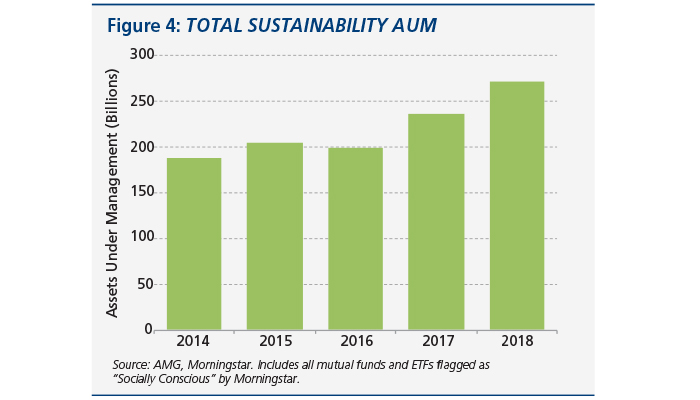

The sustainable investing industry is still young. While the U.S. Forum for Sustainable and Responsible Investment (SIF) estimates $8.7 trillion of professionally managed U.S. assets consider sustainability in some way,1 Illustrated in Figure 4, only about $250 billion of that is invested in mutual funds or ETFs that are actively seeking businesses that align with ESG values (as opposed to simply screening out certain types of businesses from their investable universe).

Should growth in this space continue at the pace set in the past couple of years, some positive developments may occur. First, companies may continue to focus more on ESG-related issues facing their businesses. Second, more sustainability focused strategies may launch, providing investors with more options. Finally, more standardized reporting in impact, both at a company level and an investment strategy level, may develop. This is important, as we can’t improve what we can’t measure.

INCORPORATING SUSTAINABLE INVESTING INTO YOUR PORTFOLIO

This paper highlights some of the nuances behind investing sustainably. Investors who wish to incorporate sustainable investing in their portfolios will have to consider several key questions, including an assessment of their values, how best to balance financial return and social impact in a portfolio, and what investment strategy aligns with their goals.

There are no one-size-fits-all solutions for this style of investing. While there are some strategies that may appeal to a broad range of investors, your goals are unique to you. Understanding options in the space and how they relate to your own personal goals are two of the key starting points to integrating ESG investments into your portfolio.

Notes

Disclosures

AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product. Data contained herein was obtained from third-party sources believed to be reliable, but AMG does not guarantee the reliability of any information contained in this report.

Member FDIC • Non-deposit investment products: Not FDIC insured, no bank guarantee, may lose value

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.