If Tax Cuts and Jobs Act Expires, Some Estate Gifts Risk Being Clawed Back

• 6 min read

- Brief: Taxes

Get the Latest Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

KEY TAKEAWAYS

- Gifts made before 2026 generally will not face additional estate tax if the current lifetime gift and estate tax exemption is lowered after 2025.

- To qualify for the currently high exemption, a gift would generally need to be irrevocable (versus one where an individual retains some control over the gifted asset).

- Certain clawback protections may not apply in complex estate planning strategies with retained interests.

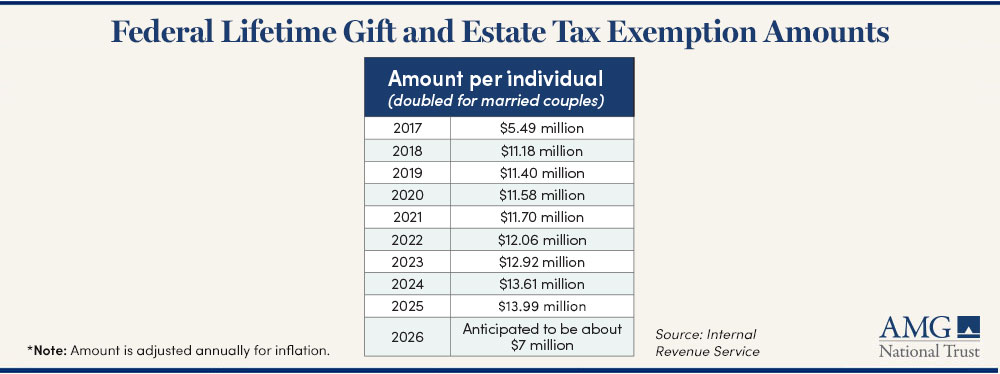

The historically high amounts that can be gifted to others through the Tax Cuts and Jobs Act (TCJA) has helped lower the tax bills of many large estates. The lifetime gift and estate tax exemption, also known as the basic exclusion amount (BEA), stands at $13.61 million per individual in 2024 (and is set to increase to $13.99 million in 2025).

The larger BEA is scheduled to be cut in half at the end of 2025 to an estimated $7 million in 2026, unless extended by Congress.

Many wealthy individuals and families are adjusting their estate planning to take advantage of the currently higher exemptions, leading to some creative and possibly concerning strategies. It has spurred the Treasury Department and Internal Revenue Service (IRS) to clarify which “gifts” qualify for the BEA.

In 2019, anti-clawback rules were issued by the IRS to prevent gifts made in 2018 through 2025 from being clawed back and taxed at a potentially lower post-2025 BEA. The IRS has since noted that these anti-clawback rules may be open to misuse by individuals who make large gifts but retain significant control or interest in the asset.

Since April 2022, proposed amendments have been working their way through the system that clarify which categories of gifts qualify to receive anti-clawback protection.

Questions around BEAs are just one aspect of the TCJA. Not all the law’s provisions are scheduled to expire. Our free special report, “Are You Prepared for The Great Tax Cut Sunset?” takes a broader look at the law and the potential impact if beneficial provisions eventually lapse.

POTENTIAL EXCEPTIONS TO THE ANTI-CLAWBACK RULE

While the general protection of the anti-clawback rule would largely remain intact, the proposed amendments carve out certain exceptions where the protection might not apply, particularly involving complex estate planning strategies with retained interests.

The dividing line generally would be whether the asset is an adjusted taxable gift (and eligible for anti-clawback protection) or an includible gift that will be included in the gross estate upon the gift donor’s death.

Adjusted taxable gift

These gifts are not included in the gross estate calculation because the donor has relinquished all control and interest over a gifted asset. The gift is considered fully completed and irrevocable. These can include:

- Outright gifts of cash or property

- Assets that are transferred to an irrevocable trust

RELATED ARTICLE: AMG administers many types of trusts.

Includible gift

This type of gift involves the donor retaining some interest, control, or rights to the gifted asset. The proposed regulations specify that if a gift is includible in the donor’s gross estate because of retained interests or powers, the estate tax calculation generally will be based on the BEA in effect at the time of death, not the BEA in the year the gift was made.

The following list is not all inclusive, but these are some examples of includible gifts:

Retained Interest (Internal Revenue Code (IRC) Section 2036). A donor transfers property but retains the right to use or receive income from the property or designate such other persons who may use or receive income from the property. Such a gift could be when a home is transferred to a child, but the donor retains the right to live in the house for the remainder of their life.

Reversionary Interest (IRC Section 2037). Property or assets are transferred, such as to a trust, but the donor retains a reversionary interest (i.e., the asset will revert to them if a specified event occurs) that is worth more than 5% of the value of the property at the time of death.

Revocable Transfers (IRC Section 2038). A donor transfers assets but retains the right to alter, amend, revoke, or terminate the transfer.

Certain Annuities (IRC Section 2039). A Grantor Retained Annuity Trust (GRAT) is established, and the donor retains the right to receive annuity payments. If the donor dies during the GRAT term, the value of the GRAT may be includible in the estate.

Transfers Within Three Years of Death (IRC Section 2035). Certain transfers made within three years of death can be includible in the gross estate, especially if they involve the relinquishment of rights or interests that would have caused estate inclusion under IRC Sections 2036, 2037, 2038 or 2042. For example, a donor transfers a life insurance policy to an irrevocable trust but dies within three years of the transfer. The value of the policy would generally be includible in the estate.

Note that the proposed amendments also provide for some exceptions to the exceptions, including circumstances where includible gifts would still generally be afforded anti-clawback protections.

PORTABILITY OF UNUSED EXEMPTION FOR SPOUSES

Another consideration is how the anti-clawback rule intersects with the Deceased Spousal Unused Exclusion (DSUE) amount. The proposed regulations generally allows for a surviving spouse to use the DSUE from a spouse who has died while the higher exclusion amount was in effect.

To do so, an estate tax return Form 706 will need to be filed in a timely manner.

CONSIDERATIONS FOR YOUR ESTATE PLANNING

Guessing whether the historically high lifetime gift and estate tax exemption will be allowed to expire in 2026 has added a level of uncertainty to estate planning. The IRS is also working to clarify anti-clawback application in scenarios involving retained interests.

Your estate planning should take into consideration that there may be further changes to the proposed amendments.

HOW AMG CAN HELP

Not a client? Find out more about AMG’s Personal Financial Management (PFM) or to book a free consultation call 303-486-1475 or email us the best day and time to reach you.

In this free special report, you’ll learn about anticipated expiration of favorable provisions in the Tax Cuts and Jobs Act that could disrupt many high-net-worth individuals’ long-term financial plans.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.