Financial Planning for Couples Marrying Later in Life

• 14 min read

Get the Latest Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

Couples who prepare to marry later in life, such as once you have established your career or even later, like retirement, will confront key financial issues that should be discussed before tying the knot. While you both are looking forward to building a life and financial partnership together, you also will want to protect the lifestyle and wealth you’ve already accumulated, as well as provide for any children from previous relationships.

Our free 9-page report, “Getting Married and Managing Wealth,” can help you tackle the many issues that can impact finances for newlyweds, particularly older couples.

HOW TO TALK ABOUT FINANCES BEFORE MARRIAGE

Marriage is a merger of two lives. It can also be a merger of money management styles and goals. Before legally binding your lives and property, an open and wide-ranging conversation about each other’s financial situation can help establish realistic goals for your shared finances in marriage.

This discussion can be beneficial because, for richer or poorer, financial issues are among the leading causes of marital disputes. Nearly three-quarters of the couples participating in a 2021 survey said that financial decision-making is an ongoing pressure point.

Financial Planning as a Couple

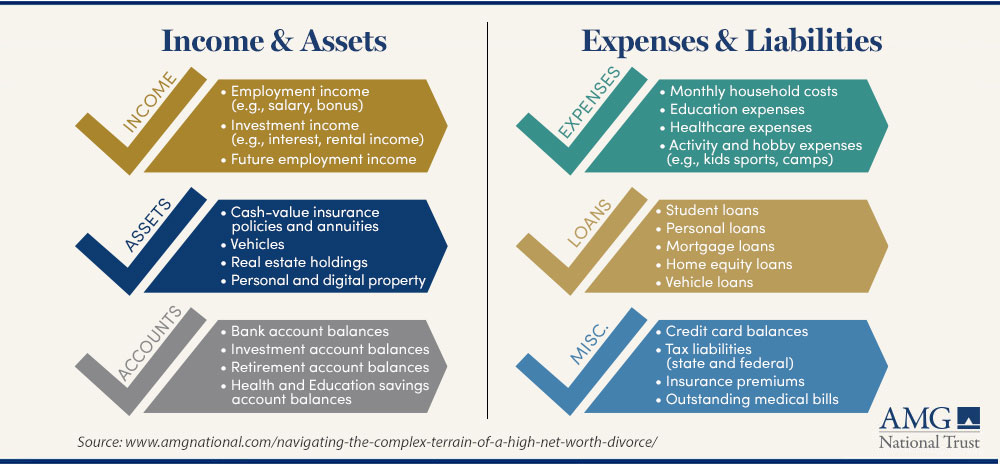

Start the conversation with a full accounting of each other’s financial situations.

List every asset in your possession—such as a business, property, vehicles, art, antiques or collectibles, savings or checking accounts, brokerage account, retirement account, pensions, and stock options.

Do the same with debts—mortgages, loans, credit cards, alimony, child support, future promises to pay (such as pledging to take care of parents if they fall ill or agreeing to contribute to a relative’s education).

This exercise serves to clearly establish your financial positions and can help delineate exactly which assets and debts you choose to treat as joint or separate property. It also helps to clarify your money management styles and spending habits.

If one of you has a number of credit cards and high debt, that likely identifies a high spender. Conversely, you could be a saver who has a large number of assets and little debt. Understanding how each of you manage money can help reach a financial middle ground.

Another point is whether to share all financial decision-making. What if one spouse is significantly wealthier, or has significantly more debt? Should the one with higher net worth automatically make the decisions?

SHOULD YOU CONSIDER A PRENUP?

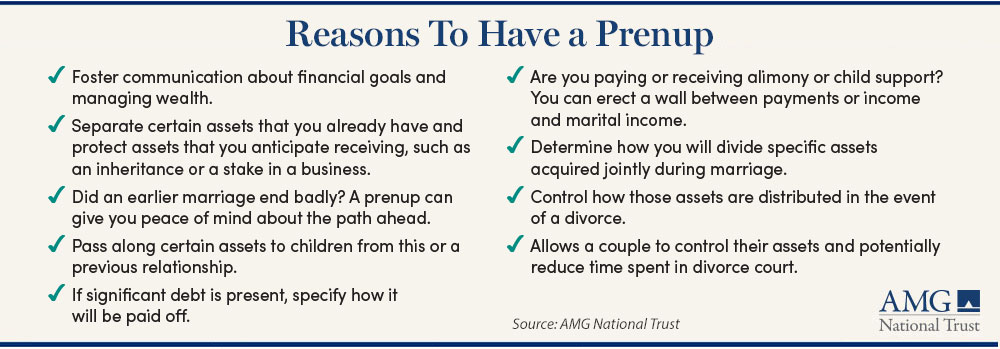

Consider a prenuptial agreement (prenup) when you wish to build guardrails around your financial assets in the event of a divorce. This consideration is particularly important to older, wealthier individuals, because the more you have can also mean you have more to lose.

Related Article: AMG’s “Navigating the Complex Terrain of a High-Net-Worth Divorce” publication includes other crucial financial planning considerations.

What is a prenup. A prenup is a legal contract signed before the “I dos.” It should not be a list of marital duties, such as who will be doing the cooking or making the bed. Rather, prenups are generally designed to outline the rights and responsibilities of each spouse should the marriage end—which often includes listing every asset and debt for both parties and indicating what happens to them.

This premarital agreement comes with conditions: it generally must be written down and agreed to voluntarily by both parties. It is also advisable for both sides to have legal representation when drafting a prenup.

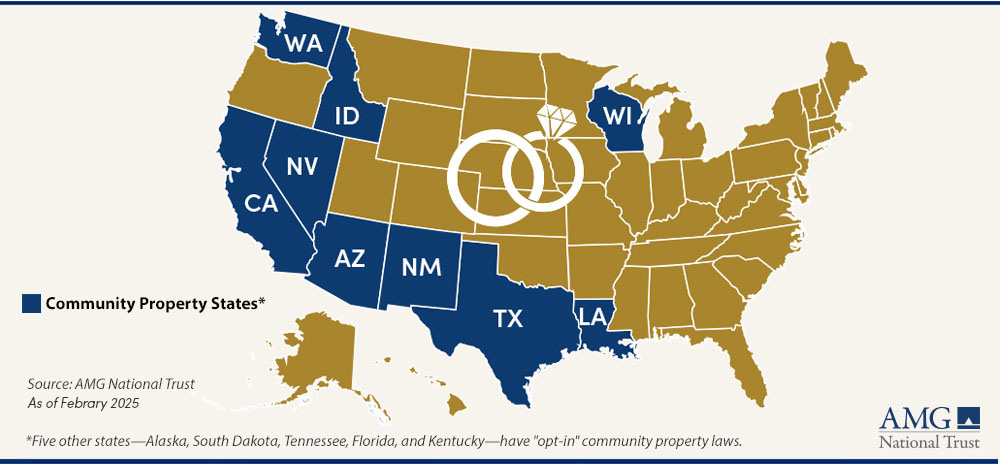

Why get a prenup. The overarching value of a prenup is that financial details within generally can override state laws in the event of a divorce, i.e., both spouses can predetermine the outcome. This can be particularly important in states that use community property laws, which would otherwise generally force a 50/50 split. However, prenups are not always ironclad against legal challenges or an individual state’s laws. Given this, it may be a good idea to include detailed explanations so that a court could consider the genesis of certain choices.

What could be included in a prenup. Negotiating the details can feel like a nuisance, but it can be better to include as many details as possible—assets and debts to be considered separate or joint, of course, but also any number of other issues, such as:

- How anticipated gifts or inheritances will be handled

- Amount of alimony or lump sum payments in the event of divorce

- Compensation for a spouse who put a career on hold to raise a family

- Custody of pets

- Whether an agreement can be modified

- End-of-life planning and estate planning

However, some issues may not be worth including. For instance, child custody, support, and visitation are matters that typically are left to courts, regardless of the existence of a prenup.

But you may want to provide for children in other ways may, such as specifying money for education or inheritance.

Trusts can also provide protection. Another option is a trust, which can be created unilaterally before marriage. Depending on the type of trust and your situation, wealth, property, and other business interests placed in a trust can be considered as owned by the trust rather than by one of the spouses and therefore not considered marital property so long as it remains separate from marital assets. There can be various factors that dictate, so consult an attorney if you’re considering a trust.

CAN YOU GET A PRENUP AFTER MARRIAGE?

Not exactly, because a prenup pertains to the time before marriage. But if you missed the pre-wedding window for a prenup, you can utilize a postnuptial agreement (postnup) after marriage. Both serve similar purposes—to clarify the handling of assets and debts.

Among other things, postnups can help a spouse take responsibility for debts such as credit cards or student loans; shield one spouse’s retirement account from the other; and establish the terms of alimony in the event of divorce.

Other common catalysts for a postnup can be:

- One spouse starts a business

- Receipt of an inheritance

- To compensate a spouse who forgoes a career to stay at home with children.

Postnups generally do not apply retroactively, and the details within can be tricky because the spouses may already have commingled assets or accumulated joint property that neither may be willing to waive their rights to. The laws on postnups vary among states, so you should consult an attorney if you’re considering one.

CONSIDERATIONS AFTER MARRYING

All the effort put into your union before you marry is likely just the beginning. Once you marry, the plans you’ve discussed to great length will need to be put into practice, and new plans can be discussed. You can carry out savings goals, dream about where you might one day live, and talk about how you both envision retirement.

Joint or Separate Accounts for Married Couples?

Overall, a little below half of all of married couples in the U.S. only have joint accounts.

Rather than making it an either/or decision, you may benefit from maintaining separate bank accounts for checking or savings but contributing to one joint account that will take care of certain expenses, such as a mortgage, vacations, utilities, groceries, and other shared responsibilities.

Separate accounts can help set up a clear division of assets in the event of a separation or divorce, but they also serve to shield or isolate a spouse’s finances in certain situations:

- To separate significant savings or hold money to pay off debt accumulated before marriage

- To hold an inheritance or windfall expected from one’s family

- A spouse is required to make alimony or child support payments, or make other payments required in a divorce decree

- To protect a partner from creditors for a debt from before the marriage

TIP: If you maintain separate accounts, consider how that money would be accessed in the event of a family emergency.

The joint or separate discussions extend to other decisions as well (these questions also can be answered through a prenuptial agreement, which is discussed below):

Your Place or Mine? If you both own a home, will you live in one and sell the other, or sell both and buy a home together? Do both names go on the deed? Who pays the mortgage? How will the mortgage payments be made? If a home has been in one family for a lengthy period, do you plan to treat it as a separate asset that will be passed down to children?

What About My Business? A business brought into a marriage may have been the product of years of personal labor. Do you intend to maintain it as separate property? What if your spouse wishes to join the business? Depending on the circumstances, any increase in the value of the business during marriage could be considered a joint asset.

Combining Credit. Spouses’ credit histories do not impact each other until applying jointly for a mortgage, loan, credit card or other account. For example, combining credit cards after marriage can impact both partners because they are equally liable for any negative information regarding joint debt. Note that once a joint account is established, disentangling them can become legally and logistically complex in the event of divorce.

A cardholder can assist a spouse with a poor credit history by making them an authorized user. The cardholder remains liable for all payments, but the authorized user can use the card and their credit score may benefit.

A decision to maintain separate credit accounts can protect credit histories, but it also means that neither spouse may be aware of the other’s full financial picture.

Child Support. A spouse receiving support payments may wish to direct those payments to a separate account used solely for the children and retain all receipts. The payments are not taxable to the recipient.

Blended families, where both spouses may bring and add children to the marriage, can blur the financial lines of who is responsible for what. While a current spouse may not have financial responsibility for the other spouse’s children, at least some of their joint income will likely go toward shared expenses, such as housing, food, and utilities.

The flip side is marrying someone making payments to a former partner. While marriage generally does not make you responsible for contributing to those payments, a court could garnish anything bearing the support-paying spouse’s name, in which case you may benefit from maintaining separate accounts.

Tax Filing Status. Married couples have the option of filing jointly or separately on their federal income tax returns to avoid finding themselves in a higher tax bracket. Joint filers generally will receive higher income thresholds for certain tax breaks and deductions. They also may qualify for tax credits for earned income, education, adoption expenses, and child/dependent care.

Comparing Standard Deductions

Married couples filing jointly are eligible for a standard deduction of $30,000 for the 2025 tax year versus $15,000 for those married filing separately.

A spouse with a large amount of out-of-pocket medical expenses may benefit from filing separately because the Internal Revenue Service allows you to deduct only the amount of those expenses that exceed 7.5% of your adjusted gross income. That threshold may be easier to meet based on one income versus two. A financial advisor and tax professional can help you better understand your options.

Retirement planning

Age differences between spouses may impact the age at which you plan to retire, along with where you hope to live and what your lifestyle will look like (there’s an age gap of at least 10 years in 20% of all new remarriages, according to a 2014 report).

As an example, say the wife is 67, the husband is 50, and they both wish to retire now. If they were each to live to 85, they would have to cover 35 years of retirement.

Some options in this situation are:

- Boost savings

- Reduce debt and adjust anticipated retirement expenses

- Prolong the time before you begin to take Social Security benefits (the maximum annual benefit for the highest income earners who reach full retirement age at 67 but wait until age 70 to retire is $61,296. Starting your benefits just three years earlier reduces that annual amount to $48,216.)

- The older spouse works a few years more while the younger spouse plans to work significantly longer to maintain health insurance

- Use Required Minimum Distributions (RMDs) from retirement accounts to your advantage

Estate planning

An estate plan is valuable to you by making sure that assets go to the people you choose and that end-of-life decisions are managed according to your wishes, and valuable to your family by providing wealth transfer that meets loved ones’ needs and minimizes taxes. It also can help ease the burden on loved ones by providing guidance on managing your affairs and medical care if you become incapacitated or die.

You don’t have to oversee estate planning on your own—in fact, you shouldn’t. Most states have specific requirements that must be met for your will and other estate planning documents to be valid. If these requirements aren’t met, if the language isn’t correct or the wording is imprecise, your instructions could be invalidated and your affairs handled according to state law.

Update wills, trusts, and insurance. Each of these documents should reflect your current situation and wishes. For instance, a remarriage can alter financial priorities, such as taking care of younger children from this marriage and older children from a previous marriage. Or you may wish to specify that a spouse continues to live in the family home until their passing, at which time the property passes to children from an earlier relationship.

Revisit beneficiary designations. Beneficiary designations should reflect your current priorities, but it’s not unusual for beneficiary designations made long ago to be forgotten. Here’s an example: A man broke up with his girlfriend in 1989 and had not seen her since, but she is set to inherit his $1 million retirement account decades later because he never removed her as a beneficiary.

Talk about your plans with loved ones. Be inclusive and transparent regarding intentions for heirs and end-of-life decisions. Clearly outline how assets will be distributed to avoid conflicts among heirs. If there are children from previous relationships, ensure the estate plan addresses their inheritance too.

Related Article: Learn more about end of life and estate planning in the AMG publication “End of Life Planning: Are You Good to Go?”

HOW AMG CAN HELP

AMG is a trusted resource for many families, especially those with complicated financial lives. To find out more about AMG’s Personal Financial Management (PFM) or to book a free consultation call 303.486.1475 or email us the best day and time to reach you.

DOWNLOAD REPORT

In this free 9-page report, you’ll learn about the issues that can impact finances for newlyweds, particularly older couples with meaningful assets.

FREQUENTLY ASKED QUESTIONS

Should newlyweds maintain joint or separate accounts?

Rather than making it an either/or decision, married couples may benefit from maintaining separate checking or savings accounts but contributing to a marriage joint bank account that will take care of certain expenses, such as a mortgage, vacations, utilities, groceries, and other shared responsibilities.

Under what circumstances should couples consider a prenup?

Couples may want to consider working out a prenup in instances such as: a large number of assets or debt will be brought into the marriage, or one or both partners wish to build guardrails around their finances to protect the interests of children from prior relationships. Considering a prenup is particularly important to older, wealthier individuals, because the more you have can also mean you have more to lose.

What can be included in a prenup?

A prenup can be most effective when it includes as many details as possible about your finances. Start with assets and debts to be considered separate or joint property, but also consider items such as how inheritances or family gifts will be managed, alimony in the event of a divorce, and compensation for a spouse who puts a career on hold. Also consider your wishes for end-of-life planning and estate planning. Decisions around child custody, support, and visitation, however, may not be worth including as they are typically decided by the court. You should consult an attorney if you’re considering a prenup.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.