Can You Have Good Income But Bad Credit?

• 12 min read

- Brief: Banking

Get the Latest Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

True or false: Someone making $20,000 can have a better credit score than an individual with a $200,000 salary?

Seems improbable, but it is entirely true.

Here’s another improbable truth: Warren Buffett is one of the world’s wealthiest individuals, yet Fortune magazine once reported that his FICO score was 718 (“good” but still near the average score of 714. A perfect score is 850).

A credit score—used to measure risk—is entirely independent of how much money you make and instead is based on how you manage your finances, i.e., how much you owe and how you pay it back.

What credit score is rich?Exceptional: 800–850. Very Good: 740–799. Good: 670–739. Fair: 580–669. |

NATIONAL CREDIT EDUCATION MONTH

March is National Credit Education Month, making it an opportunity to learn how credit scores affect common financial events and how you can improve yours.

Buying a home or new car? Poor credit can lead to a higher interest rate on the loan. You also would pay more to insure them.

Poor credit can also lead to roadblocks with rental applications, security deposits for utilities, cellphone contracts, and background checks for employment. A credit check generally is part of the review for each.

The impact of poor credit does not fade easily. A credit reporting bureau generally can report most negative information for seven years.

Major Credit Bureaus

- Equifax: 800-349-9960; equifax.com; Fraud Victim Assistance Department, Consumer Fraud Division, P.O. Box 740256, Atlanta, GA 30374

- Experian: 888-EXPERIAN (397-3742); experian.com; National Consumer Assistance, P.O. Box 9554, Allen, TX 75013

- TransUnion: 888-909-8872; transunion.com; Fraud Victim Assistance Department, P.O. Box 2000, Chester, PA 19016-2000

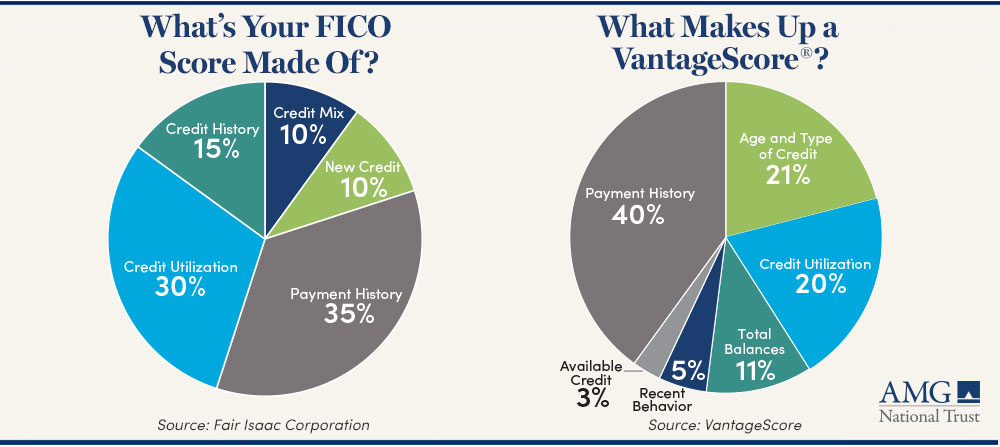

TWO METHODS OF CREDIT SCORING

Credit scores are a predictor of your payment behavior and are calculated using credit scoring algorithms. The two most widely used credit scoring algorithms come from FICO and VantageScore®.

While the FICO credit score is more popular among lenders, they also may reference VantageScore. Both use the same scoring range of 300 to 850.

Like some fine wines, scores generally improve with age: The Silent Generation (those born from 1928-1945) have an average score of 760. Baby Boomers (1946-1964) are at 740; Gen X (1965-1980) at 705; Millennials (1981-1996) at 686; and Gen Z (1997-2012) at 679.

Overall, the average credit score for U.S. consumers hit an all-time high of 714 in 2022. That’s a 25-point jump over the last 10 years.

WHAT’S IN YOUR CREDIT SCORE

The ingredients are similar for both algorithms:

Payment history

Probably the most important factor and the easiest to improve—if you pay your bills on time every time, your score probably is in good shape.

Amounts owed

What you owe relative to how much credit you have available is known as your credit utilization ratio. If you owe $35,000 on your credit cards and have a credit limit of $100,000, you have a credit utilization ratio of 35%. Credit bureaus typically don’t like to see a ratio of more than 30%.

Length of credit history

The longer you have had your accounts, the better. To improve this part of your score, keep your oldest accounts active and avoid opening new ones.

Type of Credit

A variety of credit accounts looks best to lenders, such as a mix of credit card debt, mortgages, student loans, auto loans, and personal loans.

New Credit Inquiries

Soft inquiries such as viewing your own credit report will not affect your FICO score. Hard inquiries such as actively applying for a new credit card or mortgage will affect your score.

In general, one instance of applying for a new line of credit will take less than five points off a FICO score. Hard inquiries may stay on your credit report for two years, although they typically only affect your credit scores for one year.

RELIEF FROM IMPACT OF UNPAID MEDICAL BILLS

Medical debt—to the tune of $88 billion in collections as of 2021—has long been a negative factor on credit reports.

Yet this type of debt differs from other personal debt. You may choose to take out a loan for a car or splurge on a big-screen TV, but a serious health event generally is out of your hands. Medical debt also may be less predictive of future payment problems than are other debt collections.

Because of these two reasons, the red mark it leaves may soon be erased voluntarily by reporting agencies and through legislation.

In phases starting in July 2022, medical bills under $500 no longer will affect your credit report—even after they are sent to collections. Further, unpaid medical collections will not be recognized until the debt is a year old. These changes, done jointly by Experian, Equifax and TransUnion, are expected to remove an estimated 70% of negative medical debt remarks, giving many a hopeful jump in their credit score.

Individuals will remain responsible for making arrangements to pay off medical debts. And any medical bill paid for with a credit card that later falls into arrears is unaffected by these reporting changes.

Several states and Congress are considering legislation to further limit the impact of medical debt on credit scores.

LOW CREDIT SCORE CAN RAISE ROOF ON OTHER COSTS

Buying a home

The difference between a credit score in the 760 to 850 range and one in the mid-600s can raise or lower your monthly payment on a 30-year, fixed rate loan. It also can mean a difference in tens of thousands of dollars in interest over the life of the loan.

Auto and property insurance

You would expect an auto insurer to consider traffic tickets, accident history and the type of car you drive. But they also look at your credit, arguing that credit-based insurance scores (which use many of the same inputs as credit scores) are a predictor of whether a driver will file claims. An analysis of car insurance rates in the majority of states that allow credit as a pricing factor reveals an average rate increase of 76% for those with poor credit. That can translate into a hike of nearly $1,180 annually on average.

The outcome is similar for homeowners. On average, insurance premiums for a homeowner with poor credit will be higher than for homeowners with excellent credit, although taking a higher deductible can help lower costs.

Student loans

The lender will conduct a hard inquiry when you first apply that will likely ding your credit score a few points, whether you end up being approved or not.

To avoid the ding of a hard inquiry, take advantage of lenders’ prequalification tools. Entering your information for a rate quote generally will trigger only a soft inquiry. The hard inquiry comes only if you decide to submit an application.

When the loan moves to the active repayment stage, the balance matters less than whether the payments are on time.

POOR CREDIT CAN MEAN FEWER LOAN OPTIONS

An individual’s low credit score raises the risk level for lenders, who compensate by implementing a higher interest rate and less than favorable repayment terms. There is no official “poor score” category, and the definition will likely vary from lender to lender. Lenders generally see those with credit scores 670 and up as acceptable or lower-risk borrowers.

The approval process for bad credit loans can be challenging, but patience and diligent research can pay off with a loan you can afford. Some options are:

Lines of credit

This is a revolving loan that can be used for any purpose. The borrower can tap the line of credit at any time, pay it back, and borrow again, up to a maximum limit set by the lender.

Lines of credit can be secured or unsecured, and there are significant differences between the two, such as the interest rate paid by the borrower.

A secured line of credit is guaranteed by collateral, such as a home, car, or real estate.

An unsecured line of credit is not guaranteed by any asset; one example is a credit card. They usually carry much higher interest rates because they’re backed solely by the borrower’s promise to repay.

Home Equity Line of Credit (HELOC)

A home equity line of credit (HELOC) is a second mortgage that borrows against your equity, which is the home’s value minus the amount you owe on the primary mortgage. It is like a credit card in that you can draw from a home equity line of credit and repay all or some of it monthly.

You can also get a HELOC if you own your home outright, in which case the HELOC is the primary mortgage.

During the draw period (for example, 10 to 15 years), you can withdraw and replenish funds as you see fit, making interest-only payments in most cases. Once you enter the repayment period (for example, 10 to 20 years), you will begin making monthly principal and interest payments to your lender.

A major downside is that you will be putting your home at risk if you can’t repay the additional debt from the loan. The financing terms also may use a variable rate that can be affected by changes in the market.

Home equity loan

Most home equity loans come with a fixed interest rate, a fixed repayment timeline, and fixed monthly payments.

But they generally only let you borrow up to 80% of your home’s value, minus what you still owe on your first mortgage. This means that, if you own a property worth $300,000, the maximum amount of equity you could borrow is $240,000 (300,000 x 0.8). If you still owe $200,000 on your mortgage, the most you can borrow with a home equity loan is $40,000 (240,000 minus 200,000).

The danger for someone already having financial issues is that it’s a lump sum payment. If you take out more than you need, you could wind up spending the excess money frivolously and eroding your home’s value in the process.

Also note that since a home equity loan offers your home as collateral, in a worst-case scenario where you couldn’t repay the loan, the bank would be able to foreclose on your home.

IMPROVE YOUR CREDIT SCORE

The key steps to go from 650 or under to 750 or more are surprisingly straightforward: Pay your bills on time, pay down debt, and avoid new hard credit inquiries.

Figure out where you stand by checking out your credit score. Federal law enables you to get a free copy of your credit report every 12 months from each of the three nationwide credit bureaus. Check for any inaccurate information or evidence of accounts fraudulently opened in your name.

Then build a realistic monthly budget and stay on track. It’s a tough task, but it will pay off.

If you’re struggling with debt, you might wish to explain to your creditors why you’re having difficulty making your payments. They may be able to work out a modified payment plan that can make your monthly payments more manageable.

While some companies promise to “repair” or “fix” your credit for an upfront fee, no one can remove negative information, such as late payments, from a credit report if it is accurate. You can only get your credit report fixed if it contains errors, and you can do that on your own for little or no cost.

FREEZE—AND PROTECT—YOUR CREDITIf you suspect an account has been fraudulently opened in your name, you can protect yourself.

|

HELP THE NEXT GENERATION BUILD CREDIT

Younger generations learn from their parents. Understanding credit basics should be one of those lessons. Yet, a recent survey of Gen Z (anyone born 1997-2012) found several misconceptions: 66% believe that building credit requires a person to carry a small balance on their card at all times (it doesn’t). More than half falsely believe that having multiple cards is bad for a person’s credit. As well, 26% say young adults do not need to worry about building credit.

Parents can help guide them along a better path:

- Open a savings account – Make them put in a basic amount each month. It can instill the need to follow a budget and put money aside for a rainy day.

- The first credit card – Issuers are often reluctant to approve a card for anyone under age 18—and sometimes even older. Parents can work with their children to explore secured card options or student card options.

- Cosign a loan – Such as an auto, student, or personal loan.

- Add them as an authorized user – Parents can add children onto their own cards as authorized users even when their children are very young. That card will show up on the child’s credit history.

HOW AMG CAN HELP

AMG is a trusted resource for many families, especially those with complicated financial lives. We’re here to help you build and manage your wealth. To find out more about AMG’s Personal Financial Management (PFM) or to book a free consultation call 303-486-1475 or email us the best day and time to reach you.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.