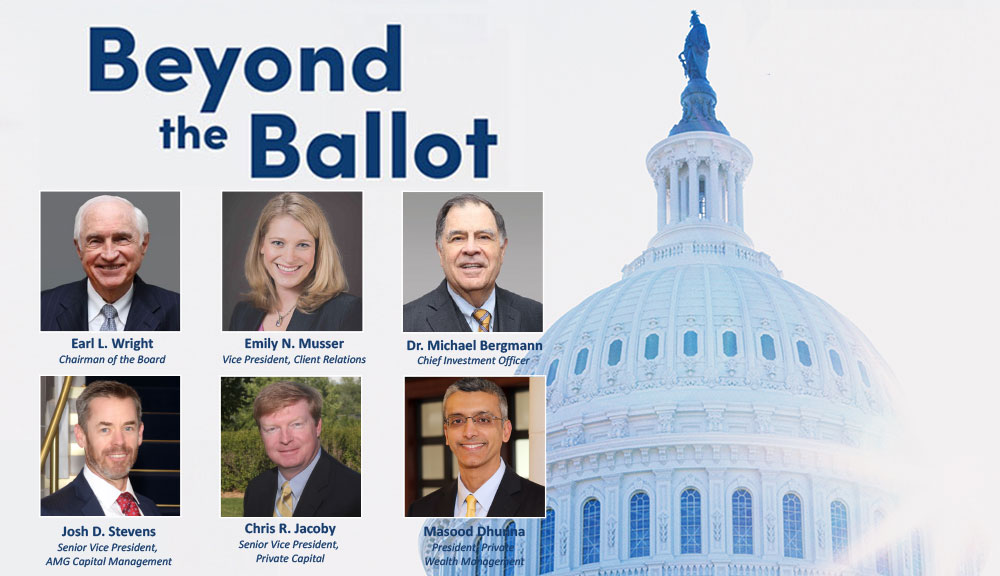

Beyond the Ballot

• 3 min read

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.

Now is the time to evaluate your income and estate taxes with the Tax Cuts & Jobs Act (TCJA) sunset “on the horizon.” That was one takeaway from AMG’s panel of experts during our Beyond the Ballot webinar on Thursday, October 24.

The presidential candidates have published many policy proposals and positions during the campaign. Regardless of the electoral outcomes, it is important to understand the policy stances of both candidates from an economic standpoint. AMG shared insights, based on rigorous analysis of information available at the time, about the presidential candidates’ proposals and the potential impact on economic growth, the fiscal health of the United States, financial markets, and building and managing wealth.

You can watch the webinar here for other takeaways, including:

- As AMG Chairman Earl Wright discussed, a divided Congress appears likely. In that case, the next president would have difficulty implementing his or her entire agenda and the current gridlock in government would continue.

- On balance, the 10% or 20% across-the-board proposed tariffs would have a negative impact on economic growth.

- Neither candidate appears to address the long-term issue of reducing the U.S. debt; this is a pressing concern that likely needs to be solved for the United States to flourish.

- A cohesive immigration policy is essential for immigration to support economic growth. Unfortunately, both candidates’ platforms include only a smattering of supportive policy choices.

- There is a persistent case for natural resources investment, including oil and gas, given the supply constraints and enormous energy needs tied to innovation and artificial intelligence (AI).

- While corporate tax rates are in the headlines, they are only one part of the policy mix that will influence markets. Investors should expect volatility while the actual policies that will be implemented become clear and markets discern the impact.

- Have your liquidity needs for the next 18-24 months covered so that surprises in the market and volatility don’t force you to sell securities at a loss.

- The expiration of the TCJA is looming, in one form or another. Now is the time to address opportunities to manage income tax liabilities. Estate taxes are slated to revert to 2017 levels (from nearly $14 million in 2025 to $7 million per person in 2026), as well. Consider talking with your advisor about taking advantage of the high estate tax exemption.

HOW AMG CAN HELP

Not a client? Find out more about AMG’s Personal Financial Management (PFM) or to book a free consultation call 303-486-1475 or email us the best day and time to reach you.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.