Getting Ready for Retirement

• 18 min read

- Brief: Life Events, Wealth Management

Get the Latest Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

Having retirement on the horizon is an exciting time, but it’s also a major life change requiring broad preparation.

In anticipation of retirement, many of us set a financial goal—a mark on the wall, so to speak—to aim for in building wealth and achieving the dreams that wealth affords. To meet that mark, it can be helpful—at least five years out—to create a checklist of key financial, healthcare, and lifestyle decisions to address in these last critical working years.

It can sound simple, yet a surprising percentage of America’s workforce—reportedly about one-quarter—have not given their retirement years much thought.

For those who have made plans, winding down a successful career and embarking on a new chapter still can bring on conflicting emotions. Especially for successful individuals who have spent most of their working life in high-achievement mode, downshifting to a different pace of life can seem daunting and negatively affect mental health.

Some may find a new focus for their energy through travel or spending time with family. Others may decide to start a new venture or serve on nonprofit or corporate boards. The options to stay engaged are endless.

Your preparations in all of these areas can help ease the transition into a successful and satisfying retirement.

TRANSITIONING INTO RETIREMENT

The last few years leading up to your planned retirement don’t allow much room for mistakes as any lost earnings won’t have significant time to recover. It’s also when solid planning for your transition from collecting peak earnings to withdrawing retirement income can help to minimize surprises and tax liabilities.

Plan for retirement, yet leave time to adjust

Starting your planning early enough to accommodate adjustments due to lifestyle choices or economic conditions can be crucial to seeing your retirement dreams come to fruition.

- Do you know how much your retirement lifestyle will cost?

- When can you consider scaling back or leaving your current job?

- Will you stay in your home or move for weather or family reasons?

- How do you hope to fill your days?

Retirement budget planning takes into account forecasted spending and income streams including investments, retirement accounts, pensions, Social Security payments, rental income, and dividends.

Retirement budget planning. Be realistic about how much income you will need to fund your desired retirement lifestyle—and how long you will need it for.

The average life expectancy for U.S. women and men is 80.2 and 74.8 years, respectively. While you can never know with certainty how long your retirement will be, you can estimate it based on family longevity and health.

Calculating expenses can be a particular concern if one spouse is considerably younger but both retire at the same time, because the savings will need to last through the younger spouse’s retirement years.

Essential expenses. Clarify whether expenses are fixed (e.g., mortgage, other loan, or insurance payments) or flexible (e.g., travel, groceries, entertainment, or filling up the car). Also consider the impact of inflation on expenses and the purchasing power of your savings over the coming decades.

Recognize that your needs may change as a retiree. Discretionary expenses typically are higher and health care spending is lower early in retirement before generally swapping positions later in life.

Because some essential expenses tend to recede while others emerge, your overall retirement budget may not vary significantly over time—which is a surprise to many.

- Maintaining home. Paying off the mortgage of a high-value property can reduce your biggest potential expense. But home maintenance expenses can increase when improvements and upkeep are factored in, along with ongoing expenses such as property taxes, insurance, and utilities.

- Daily living. Essential expenses include food, household supplies, and transportation. If you enjoy cooking and treat every day as a weekend day, food costs may rise as you indulge your family with more expansive meals. Likewise, you may eat out more or take up new hobbies.

- Health care. Health care can be one of the biggest expenses in retirement. A 2024 report suggests that someone retiring this year will have on average $165,000 in health care costs through retirement. As retirees live longer and the cost of medical care rises faster than general inflation, this amount keeps rising.

- Inflation. Anticipate that your costs will likely rise each year. For proof, look no further than the Consumer Price Index, which measures the average change in price over time of a market basket of consumer goods and services. It’s gone up every year for the past three decades, with the exception of 2009.

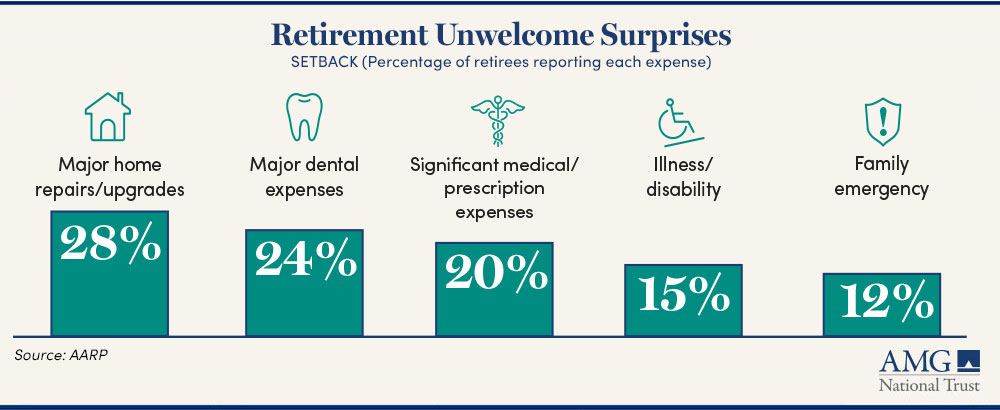

Discretionary expenses. The transition into retirement can bring on what is colloquially known as the “retirement blues” as retirees navigate shifts in daily routines, changes in personal identity, and potential loss of social connections. According to the NIH, an estimated 28% of early retirees say they feel depressed, a rate substantially higher than that of the overall older adult population.

Those who maintain a positive outlook tend to think of their golden years as a time to shift their daily routine and spending priorities from meeting just core needs to more aspirational pursuits, higher-order activities that affirm self-worth—whether through creative pursuits, travel, learning new skills or engaging in meaningful philanthropy.

Discretionary expenses that nourish the soul and cultivate purpose can be seen not as indulgent splurges but as investments in ourselves and our legacy.

- Travel. Journeying away from home is important to about two-thirds of Americans aged 50 and older, and up to 10% of annual retirement budgets often are set aside for travel.

- Hobbies. Finding “communities” who share your interests can be especially rewarding. These can be groups set up for walking or sports like golf, pickleball or tennis. Others may focus on supporting the arts.

- Planned gifts. It turns out that human brains may be hard-wired for generosity. Giving to others tends to light up the brain’s reward centers, according to a Northwestern University Medical School study. Your legacy planning may include helping to fund a child’s wedding, grandchildren’s schooling, or other assistance to people and causes important to you.

Related publication: “How Will I Be Remembered?”

FUNDING HEALTH CARE COSTS

Planning for a secure retirement begins with a comprehensive strategy that addresses both expected needs and unforeseen challenges—none more critical than health care.

It’s important to allocate sufficient funds so that you can access quality medical care, manage potential chronic conditions, and maintain your well-being—ultimately protecting your financial stability and quality of life as you age.

Self-funding healthcare. Self-funding health care costs may appeal to wealthy individuals able to use their resources to pay out-of-pocket for their health expenses. It provides more control of your assets such as deciding how to deploy the money that might otherwise go toward insurance premiums. However, it also can require comprehensive planning to anticipate future costs.

If you use a Health Savings Account, contributions must be discontinued after age 65 and if you are enrolled in Medicare. But the money then becomes eligible for non-qualified medical expenses such as gym memberships, cosmetic procedures, and supplements. Note that withdrawals for non-qualified uses would be subject to ordinary taxes.

Enrolling in Medicare. When you are age 65, you are generally eligible to enroll in Medicare, the federal health insurance program for seniors. Medicare is not mandatory, but not utilizing the enrollment period (the three months before and the three months after your 65th birthday) can lead to significant financial penalties if you choose to seek coverage later.

Traditional Medicare provides coverage for:

- Part A—hospital or nursing home care;

- Part B—physician and diagnostic services, and outpatient care;

- Part D—prescription drugs.

Part C plans, also known as Medicare Advantage Plans, are insurance plans offered by private companies approved by Medicare administrators. Part C plans provide for most of the benefits of Traditional Medicare Parts A and B, and typically D. They may also include coverage for vision, hearing, dental, and wellness programs, including gym memberships.

Medicare Advantage Plans differ from traditional Medicare in that they may have different rules for how you get services. For example, some may require a referral to see a specialist or only allow you to use doctors, facilities, or suppliers that belong to the plan.

Considering long-term care insurance (LTCI). On average, there’s nearly a 70% chance that an individual will need some type of long-term care (LTC) after age 65, according to statistics from the U.S. Department of Health & Human Services, last modified in 2020.

While most of us experience gradual aging, sudden long-term care needs can arise, such as when recovering from a heart attack, stroke, or a major bone fracture. Additionally, Alzheimer’s disease and dementia are on the rise, currently affecting over 6 million Americans over age 65, or about 1 in 9.

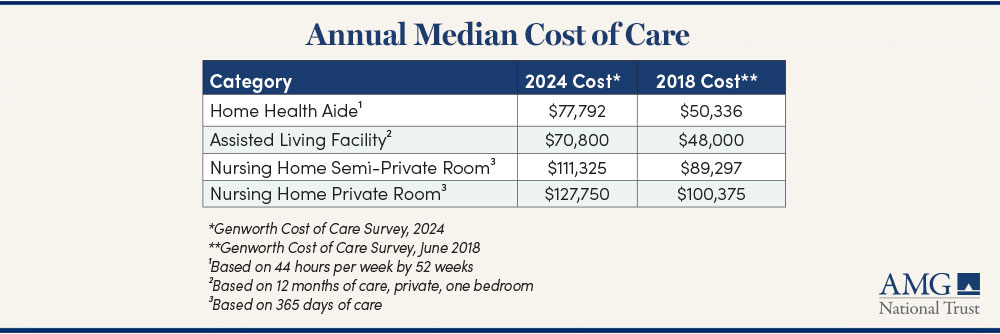

The level of care needed can range from having a family member or skilled caregiver in your home to moving into a specialized facility. The cost can be significant and will vary based on the state where you reside.

Traditional, private health insurance generally does not cover assisted-living care, though providers may cover some medical services within such a facility. An alternative is long-term care insurance that provides an established level of benefits, for instance, a maximum benefit of $300 per day for 365 days.

Policies have evolved similar to some life, home, or auto policies—you can get as little or as much coverage as you choose. The level of coverage and your age are among factors that determine the monthly premium in order for the insurer to be compensated for rising costs and Americans’ longer lifespans.

For example, the average annual premium in 2023 for a single male at age 55 was $900 for a $165,000 benefit, and $1,500 for a single female, with a discount for married couples. By age 65, the average annual premiums would rise to $1,700 and $2,700, respectively.

Related publication: How Will You Pay for the Long-Term Care You’re Likely to Need?

INVESTING CONSIDERATIONS LEADING INTO RETIREMENT

In terms of your investments, some considerations to discuss with your financial advisor include:

- What will be your retirement account withdrawal rate? Typically, it is in the range of 3% to 5%. That becomes the amount of funds used in the first year of retirement. Subsequent years use the same dollar amount but are adjusted for inflation.

- How will you determine which investment accounts to draw down each year? The sequencing of withdrawals from tax-deferred, tax-exempt, and taxable accounts has tax implications.

- How will you guard against having to sell long-term investments in a down market? Cash flow planning can help you cover essential monthly expenses while leaving your strategic investment plan intact.

- Do you wish to invest surplus wealth in future generations? Or your community? Crafting a constructive legacy can fill one’s life with profound personal satisfaction and meaning.

Catch-up contributions

Retirement account owners who are age 50 or older at the end of the calendar year can benefit from annual catch-up contributions. The idea is to make up for the years you didn’t save a higher amount, probably when younger. The Internal Revenue Service (IRS) updates contribution limits each year for Individual Retirement Accounts (IRA) and 401(k) and profit-sharing plans.

Health Savings Accounts (HSAs) are a tax-efficient way to self-fund health care costs—and can be a valuable tool for general retirement savings. Money in an HSA offers a triple-tax advantage in that contributions are tax-deductible, appreciation is tax-deferred, and spending is tax-free if used for qualified medical expenses—including for long-term care (and the amount allowed for long-term care increases as you grow older).

HSA members can contribute up to the annual maximum amount that is set by the IRS. Those 55 and older who are eligible may contribute an extra $1,000 to their annual maximum amount.

Asset allocation

Your investment portfolio may perform best when it balances conservative and growth investments because diversification can help you play offense and defense amid different market conditions. It also should match your risk tolerance and goals.

Generally, a rebalancing of your portfolio can be useful at least once a year, but this review should also consider the impact of any fees or tax implications related to the adjustment.

Single-stock concentration

Someone who has created substantial wealth, perhaps through a concentrated investment position, may be inclined to worry about potentially missing out on future higher returns if they are encouraged to consider a more balanced approach in their portfolio.

Consider the multitude of external events that could impact a concentrated investment: legislative, regulatory, industry, or an issue with the company’s products or services. Portfolio recovery (the length of time it takes to recover from a large loss) also comes into play.

Choosing to diversify from a concentrated position is just the start. Other considerations include the financial and tax implications of selling one investment to buy another, as well as what to reinvest in. Your advisor can suggest options that coincide with your risk tolerance and goals.

Sequence of returns risk

The risk of a market downturn just as you are about to begin taking withdrawals is a danger that can be tempered by planning ahead. Retirees in this predicament, known as a sequence of returns risk, face the threat of running through their savings far earlier than if a downturn occurred later in retirement. The reason: As your portfolio loses value, more of it must be sold to maintain your cash needs, leaving less available to grow during future recoveries.

A strategy to combat sequence of returns risk is to maintain one to two years of cash or cash flow on hand to see you through a downturn, limiting the need to sell investments at a loss.

Consolidating retirement accounts

If you have changed employers multiple times, you may have several employer-sponsored retirement accounts to monitor. Consolidating several accounts into a new account may be to your benefit if it can lower administrative fees, simplify finances, and make it easier to prepare taxes. On the flip side, not all accounts have the same investment choices, so take the time to compare all the options.

An advisor can review your accounts and their associated fees and investment selections to help determine which to keep as is and which to consolidate.

RETIREMENT INCOME CONSIDERATIONS

Defined benefit pension plans are a fading benefit for most Americans and are available to only about one in 10 private sector workers. Yet a public pension is widely through the Social Security program.

Social Security

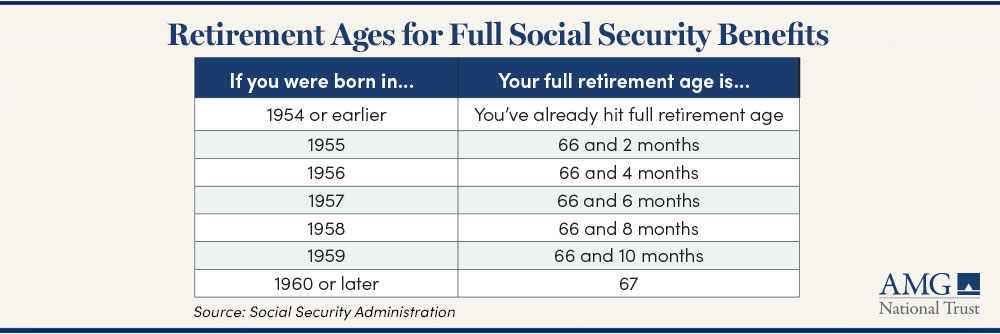

Retirees are eligible to apply for Social Security payments at age 62, but the benefits will be about 30% less than if taken at full retirement age (FRA), which for most people is age 67. If you are able, waiting further can increase the benefit amount by 8% for each year, up to age 70.

In 2025, the maximum for someone who begins taking benefits at age 70 is just over $61,000 annually.

Note that 85% of benefits are taxable above combined annual income thresholds of $34,000 for single filers and $44,000 for married filing jointly, which is a surprise for many people. Include this tax liability in your retirement budget.

States With No Income Tax

Alaska • Florida • Nevada • South Dakota • Texas • Washington • Wyoming

New Hampshire and Tennessee also currently don’t have income taxes for earned income.

Required Minimum Distributions (RMDs)

Most people save for retirement with a mix of tax-advantaged retirement accounts—such as traditional and Roth 401(k)s and IRAs—taxable brokerage accounts and other investments, such as real estate. You can begin to take penalty-free withdrawals from retirement accounts at age 59½ (if the account has been open at least five years).

With Traditional IRAs and 401(k)s and some other retirement accounts that are tax deferred—meaning they’ll be taxed upon withdrawal—most people must take Required Minimum Distributions (RMDs) starting at age 73. Working beyond age 73 can allow you to delay having to take RMDs if you continue to contribute to a 401(k) through your employer. However, this generally works only for the 401(k) at your current employer.

The annual RMD withdrawal factor generally goes down as you get older, which means the amount you are required to withdraw (distribution) goes up as life expectancy (distribution period) decreases. You can make a rough calculation of annual RMD amounts here.

Roth accounts are funded with after-tax dollars, so RMDs are not required from Roth accounts during the original owner’s lifetime.

Many retirees choose to convert all or a portion of their traditional IRA or 401(k) funds into a Roth account, making a bet that their current tax bracket will be lower than one years from now or to save their beneficiaries from paying taxes on an inherited account. Taxes will be owed on converted funds in the year of the conversion. Converting a portion of an account each year rather than the entire account can help reduce the annual tax burden.

Upon reaching age 70½, a qualified charitable distribution (QCD) allows individuals to distribute up to $100,000 per year, indexed annually for inflation ($108,000 in 2025), from an IRA to qualified charities and foundations. QCDs can count toward satisfying RMDs for the year.

State tax on retirement income

Moving to a state with lower or no income tax is not a decision to be taken lightly. Yet staying in a high-tax state due to your career opportunities does not mean you have to continue to live there in retirement.

While lower income taxes can be enticing, look at all the state tax laws, such as estate and inheritance taxes, and rules regarding trusts and estate administration. Also determine whether you’ll be paying for lower income taxes in other ways, for example, with higher sales, property, or fuel taxes. Finally, understand the requirements to establish residency in a state.

Looking at U.S. Census Bureau data, the biggest population gainers in 2020 and 2021 were Texas and Florida, at the expense of higher-tax states such as California, New York, and Illinois. Retirees, though, may be surprised by potentially higher property taxes and healthcare costs in these two Sunbelt states, respectively.

CONCLUSION

Planning your retirement years involves navigating myriad complex decisions. A detailed retirement budget should reflect how income and expenses may evolve, including the impact of inflation and what your potential tax liabilities may be. As you age, health care needs are likely to become a larger expense, potentially crowding out your discretionary spending if not funded properly.

Generating retirement income requires careful planning to ensure your funds last throughout your golden years. A significant risk to your investment plan is experiencing a market downturn in the first years of retirement, known as sequence of returns risk, which can deplete your savings faster than anticipated. To mitigate this, it’s important to maintain adequate liquidity and to strategize the order of withdrawals from various accounts, considering tax implications.

It is crucial to get these financial pieces right, as there may not be much time to recover from mistakes. An AMG wealth advisor can help you plan a seamless transition into your retirement years, navigating the intricacies of retirement budget planning, optimizing your retirement savings and investments, and developing a robust retirement income strategy. With our expertise, you can confidently step into a financially secure retirement.

FOR MORE INFORMATION

To learn more about retirement planning and wealth management at AMG, call 800-999-2190 or email with the best day and time to reach you.

DOWNLOAD REPORT

Frequently Asked Questions

It’s best to begin retirement planning early and no later than five years before you retire, as this can give you enough time to set clear financial goals and prepare for the lifestyle changes ahead. Early planning allows you to adjust for market fluctuations and helps ensure that your retirement budget, including healthcare funding, aligns with your long-term objectives.

Managing healthcare expenses is crucial for a secure retirement, as these costs can quickly escalate. Consider self-funding through Health Savings Accounts (HSAs) for a tax-efficient way to cover medical expenses. Understand Medicare enrollment to avoid penalties and costs that may not be covered. Plan for potential long-term care needs to protect your legacy.

Sequence of returns risk refers to the potential financial harm caused by a market downturn early in retirement, which can force you to withdraw investments at a loss and deplete your savings faster. By maintaining a cash reserve and strategically planning your withdrawal rates from various retirement accounts, you can mitigate this risk and safeguard your long-term investment plan and retirement income strategy.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.