Manager of the Decade in PSN Small-Mid Value Universe

• 5 min read

Get the Latest Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

LI Blurb: Quarterly PSN Top Guns List published by Zephyr identifies best-in-class separate accounts, managed accounts, and managed ETF strategies.

AMG Capital Management’s (ACM) Small and Mid Cap Portfolio Strategy has been named to the celebrated PSN Top Guns List of best performing separate accounts, managed accounts, and managed ETF strategies for Q4 2024, including Manager of the Decade in the Small-Mid Value Universe.

This highly anticipated list, published by Zephyr, remains one of the most important references for investors and asset managers. Through a combination of proprietary performance screens, PSN Top Guns recognizes products in over 75 peer group universes based on performance and risk characteristics over time.

“Successful investment strategies are the result of enormous effort, research and hard work. PSN Top Guns shines a light on the very best. The teams and managers behind each product showcase why separately managed accounts continue to grow in today’s economic climate.”

Nick Williams, PSN Product Manager

ACM Small and Mid Cap Portfolio Strategy

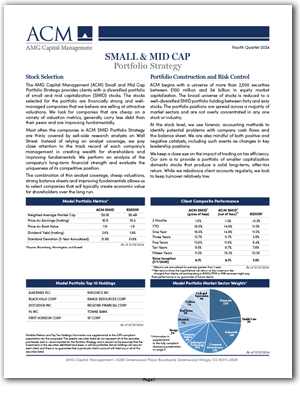

ACM Small and Mid Cap Portfolio Strategy provides clients with a diversified portfolio of about 40-60 small- and mid-capitalization (SMID) stocks. The stocks selected for the portfolio are considered to be financially strong and well-managed companies that ACM believes generally carry less debt than their peers, exhibit improving fundamentals, and are selling at attractive valuations based on a variety of valuation metrics.

“ACM portfolios are built on rigorous data-driven equity analysis in the context of the macroeconomy. This research is appreciated by our clients and it’s an honor to see our SMID strategy be recognized by PSN Top Guns."

Josh Stevens, Senior Vice President, Investment Group

FOR MORE INFORMATION

Explore how a portfolio constructed for risk-adjusted performance potential and tax efficiency can add value.

DISCLOSURES

The PSN universes were created using the information collected through the PSN investment manager questionnaire and use only gross of fee returns. PSN Top Guns investment managers must claim that they are GIPs compliant.

Non-Commingled Fund Universes exclude mutual funds, commingled funds, pooled funds, collective trusts, limited partnerships, offshore funds, wrap products, hedge funds, and MLP’s.

Manager of the Decade: Products must have an r-squared of 0.80 or greater relative to the style benchmark for the latest ten-year period. Moreover, products must have returns greater than the style benchmark for the latest ten-year period and also standard deviation less than the style benchmark for the latest ten-year period. At this point, the top ten performers for the latest ten-year period become the PSN Top Guns Manager of the Decade.

Bull & Bear Masters: Products must have an r-squared of 0.80 or greater relative to the style benchmark for the recent three-year period. Moreover, products must have an Upside Market Capture ratio of 100 or more for the latest three-year period, and Downside Market Capture ratio of 100 or less for the latest three-year period. The top ten Ratios between Upside Market Capture Ratio and Downside Capture Ratio become the PSN Bull & Bear Masters.

6 STAR CATEGORY: Products must have an R-Squared of 0.80 or greater relative to the style benchmark for the recent five-year period. Moreover, products must have returns greater than the style benchmark for the three latest three-year rolling periods. Products are then selected which have a standard deviation for the five-year period equal or less than the median standard deviation for the peer group. The top ten information ratios for the latest five-year period then become the TOP GUNS.

5 STAR CATEGORY: Products must have an R-Squared of 0.80 or greater relative to the style benchmark for the recent five-year period. Moreover, products must have returns greater than the style benchmark for the three latest three-year rolling periods. Products are then selected which have a standard deviation for the five-year period equal or less than the median standard deviation for the peer group. The top ten returns for the latest three-year period then become the TOP GUNS.

4 STAR CATEGORY: Products must have an r-squared of 0.80 or greater relative to the style benchmark for the recent five-year period. Moreover, products must have returns greater than the style benchmark for the three latest three-year rolling periods. The top ten returns for the latest three-year period then become the TOP GUNS.

3 STAR CATEGORY: These top performers are strictly based on returns for the three-year period.

2 STAR CATEGORY: These top performers are strictly based on returns for the one-year period.

The complete list of PSN Top Guns and an overview of the methodology can be located at https://psn.fi.informais.com/. Registration is required.

About PSN

For nearly four decades, PSN has been a top resource for investment professionals. Asset managers rely on Zephyr’s PSN to effectively reach institutional and retail investors. Over 2,800 firms, 285 universes, and more than 21,000 products comprise the PSN SMA database showing asset breakdowns, compliance, key personnel, ownership diversity, ESG, business objectives and strategy, style, fees, GIC sectors, fixed income ranges and full holdings. Unique to PSN is its robust historical database of nearly 40 Years of Data Including Net and Gross-of-Fee Returns. Visit PSN online to learn more.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.