Are You Looking for Wealth Management or Investment Management?

• 7 min read

- Brief: Wealth Management

Get the Latest Research & Insights

Sign up to receive an email summary of new articles posted to AMG Research & Insights.

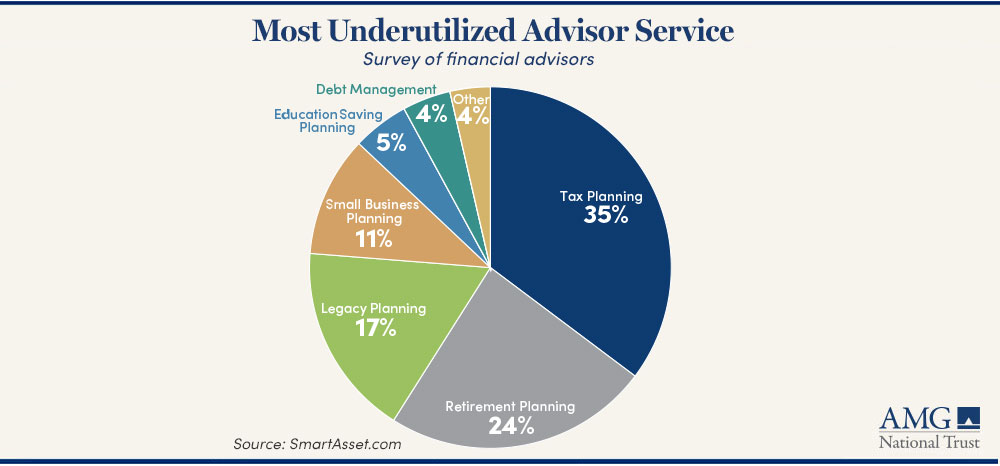

Understanding where to turn for help when trying to organize your finances can be a struggle. You may focus on a single portion of a financial plan, such as investments. And while important, investment management is typically one service included in a list of broader financial planning, tax planning, and trust and estate planning services offered by a comprehensive wealth manager.

We at AMG believe comprehensive wealth management should encompass a client’s total financial picture and provide for all needs at all life stages, from wealth accumulation to retirement income to wealth transfer.

Given the range of possible services, we recommend you evaluate your financial advisor’s service model to ensure you understand what is included in their offering and whether there is a separate charge for services, such as financial planning.

An integrated and comprehensive wealth management plan may incorporate these elements:

- Cashflow analysis and budgeting

- Compensation and benefits analysis

- Education funding planning

- Retirement planning

- Asset protection strategies and insurance guidance

- Legacy planning

- Capital gains/losses timing

- Asset location strategies, e.g., using tax-advantaged accounts

- Wealth transfer, e.g., trust and estate planning and charitable giving

- Risk tolerance-based asset allocation

- Security and manager selection

- Tax-efficient trading and portfolio rebalancing

- Periodic performance reporting

Related services

- Tax preparation

- Trust administration

- Personal banking, e.g., loans

- Investment banking, e.g., advisory on sale of a business

Financial planning

Individuals’ financial plans should not be one size fits all. Essentially, you set out your short- and long-term goals that incorporate, among other things, assets, debt, cash flow, family financial needs and investment risk tolerance.

Your financial planner should come up with a comprehensive, customized plan to meet those goals that can answer questions such as: When can you retire? How do you finance your kids’ college costs? What types of insurance should you have?

The plan should include ways to track your progress. And it should be updated regularly for major life events such as marriage, children, or divorce, and if you switch jobs or experience a change in income.

Education planning

How much time is on your side to save for a child’s college costs? The time span will guide how much you are recommended to put aside each year, for example, in a tax-advantaged 529 college savings plan.

A 529 plan can be either a prepaid tuition plan or education savings plan. They can be a tax-efficient way to save for a range of continuing education programs, technical programs, undergraduate programs, graduate programs, and, in some states, K-12 schools.

Grandparents, or anyone else, can contribute to 529 plans that they or another person own. Through a lump-sum contribution, grandparents can supercharge a 529 and also reduce their own taxable estate by the amount of the contribution.

Another option for your planning is an Education Savings Account (ESA), also known as a Coverdell account. While the contribution limit per year is fairly low, an ESA is also a tax-advantaged account and typically offers a much wider number of investments to choose from than a 529.

Retirement planning

Do you have an age in mind when you hope to retire, or do you hope to continue working? Your plan should be tailored to your specific goals and circumstances, and flexible enough to give you financial choices when life inevitably takes unexpected detours. You should be able to:

- See what your income and expenses might look like before and after retirement age

- Identify your short- and long-term liquidity needs

- Account for the potential risks associated with disability, death, or changes in your life situation

- Project your taxes and income into the future

- Determine an appropriate investment allocation to help meet your specific needs now and into the future

- View when and how to exercise your company stock options

Our free, 7-page report breaks down common myths about retirement planning.

Asset protection strategies and insurance guidance

Think of insurance as a tool to help you build, protect, or transfer wealth. It can provide financial support for loved ones after you are gone. It can help repair or replace a home, car or other asset. In the case of permanent life insurance, it also can be used to build cash value that can be borrowed against while the policyholder is alive. It also can help lower taxes on your estate.

- Tax benefits. The death benefit generally is income tax-free for the beneficiary. If an heir would face the federal estate tax, or if you live in a state with an estate tax, naming a trust as the beneficiary can potentially lower taxes and enable distributions to minor beneficiaries of the trust.

- Cash value. A permanent life policy that has built up a cash value may allow the policyholder to borrow against it tax free to supplement income, for example, in retirement.

- Predictability. The payout amount at death is a predetermined amount.

Tax planning

In any calendar year there are opportunities to capture “tax alpha” (the potential value from tax effective management of your investments) by making prudent decisions around the timing of your income, spending, capturing of investment gains and losses, contributing to a traditional or Roth 401(k), assisting grandchildren with education expenses through 529 plans, planning charitable gifts, and transferring wealth from your taxable estate. (See our insights on year-end tax planning reminders.)

Thoughtful tax planning should be adjusted at various phases of your life. Generally, younger workers may be advised to utilize tax-deferred strategies or take advantage of tax credits.

Later in life, when you begin making withdrawals or required minimum distributions, tax planning should shift to ways to minimize your annual tax burden and lower your taxable estate.

Trust and estate planning

Trust and estate planning involves preserving the value of all that you have worked to achieve and deciding who gets what and how—and in the most tax-efficient way.

Legacy and end-of-life planning, however, are about more than the value of your estate. It can help you avoid costly mistakes and provide peace of mind for you and your loved ones. An adviser can help guide you on the potential benefits of explaining to loved ones why they’re receiving money or property and what you hope they achieve with it.

Foremost, you should be assured that taxes will be minimized, and your estate will transition efficiently, as well as being advised of gifting strategies including charities or 529 college savings plans. Other elements worth considering include an end-of-life checklist, living will, and life instructions, among other items. “Are You Good to Go?” lays out what we think should be in every comprehensive plan.

Investment management

The management of your investment portfolio should be coordinated with other assets and aligned to match your retirement and estate planning.

You should receive an individualized and comprehensive investment policy statement summarizing your objectives and goals and outlining how they may be achieved. It can be thought of as general rules of conduct for your wealth manager, and it should define:

- Level of risk you are willing to accept

- The selection of assets for your portfolio, for example, 60% equities and 40% fixed income

- Costs involved with the trades, including any taxable capital gains

- Whether a discretionary or non-discretionary account, meaning does your advisor have permission to make trades on your behalf or do you approve each trade

- Timing of portfolio performance monitoring and reporting

HOW AMG CAN HELP

For almost 50 years, AMG has been a trusted resource for many families, especially those with complicated financial lives. We’re here to help you build and manage your wealth through integrated financial planning, investment management, access to private capital, tax preparation, trust administration, charitable giving, retirement plan administration, and banking services. To find out more about AMG’s Personal Financial Management (PFM) or to book a free consultation call 303-486-1475 or email us the best day and time to reach you.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.